Recent rumors on X wrongly accused presidential candidate Kamala Harris of endorsing President Biden’s 2025 proposal for a 25% tax on unrealized capital gains.

Earlier this week, thousands of crypto investors found themselves caught up in a whirlwind of misinformation. Many prominent accounts reported that U.S. presidential candidate Kamala Harris had endorsed a new tax on unrealized gains, originally proposed by President Joe Biden for 2025.

Social media, especially X, buzzed with outrage. People retweeted and reacted to the misinterpreted headlines, convinced that Harris wanted to tax unrealized capital gains at 25% next year. The mass disapproval expressed on X seemed to imply that members of the crypto community thought this proposed tax would impact all U.S. investors, regardless of their net worth.

Unrealized gains refer to the amount an asset has gained in value before selling it and taking the profit. For example, if you bought Bitcoin at $50,000 and its value grew 22%, you don’t realize those gains until you sell your BTC.

The outcry was fueled by a misunderstanding after Harris’s campaign team released her economic plan. They stated that if elected, she would raise the corporate tax rate—a proposal previously put forward by the Biden administration.

Many assumed Harris’s team had officially endorsed the current administration’s entire tax policy proposal for 2025, which mentions unrealized gains as part of a new minimum tax on the ultra-wealthy. However, this was not true.

As pointed out by crypto investor and analyst Adam Cochran, Harris’s team did not endorse, comment on, or reference the 256-page document “General Explanations of the Administration’s Fiscal Year 2025 Revenue Proposals,” published in March.

However, someone on X read part of the extensive Biden proposal, which includes a new minimum tax of 25% on total income (including unrealized capital gains) for people with more than $100 million in wealth.

“The proposal would impose a minimum tax of 25 percent on total income, generally inclusive of unrealized capital gains, for all taxpayers with wealth (that is, the difference obtained by subtracting liabilities from assets) greater than $100 million.”

Biden’s tax proposal for 2025

Taken out of context, the rumors took on a life of their own and spread across the crypto community.

Decoding Harris’s taxation proposal and its impact on crypto

Harris did, in fact, reveal part of her proposed economic agenda, including a series of tax proposals. Here’s what we know so far.

First, Harris has expressed support for raising the corporate income tax rate from 21% to 28%. This move is expected to generate significant revenue for the federal government, potentially increasing tax receipts by up to $1.4 trillion over the next decade.

This proposed increase in the corporate tax rate could impact crypto companies, especially larger entities like exchanges or mining operations. Higher taxes could lead to reduced investment in new projects or increased fees for users as companies seek to cover their rising tax obligations.

Harris is also focused on making housing more affordable. She’s proposing several tax incentives to encourage the construction of new homes, particularly for first-time buyers and renters.

For example, she plans to offer tax breaks to companies that build affordable housing and provide up to $25,000 in down payment support for new homeowners to address rising housing costs in the U.S.

While tokenized real estate could come into play here, it’s not clear that the housing-related policy proposals affect crypto holders specifically.

What is Biden’s proposal for capital gains tax?

Again, the confusion about Harris’s rumored endorsement of Biden’s proposed tax on unrealized capital gains stems from misunderstandings. However, Biden’s plan includes proposals to increase the tax burden on the wealthiest Americans.

“Preferential tax rates on long-term capital gains and qualified dividends disproportionately benefit high-income taxpayers and provide many high-income taxpayers with a lower tax rate than many low- and middle-income taxpayers.”

The proposal seeks to close a loophole in the system that lets wealthier individuals pass on the appreciated value of their assets to their beneficiaries without paying income tax on those gains.

Currently, long-term capital gains are taxed at a maximum rate of 20%, or 23.8% when including the 3.8% net investment income tax (NIIT). For high-income earners with taxable income exceeding $1 million, Biden’s proposal would tax long-term capital gains at ordinary income tax rates, potentially reaching 44.6%.

This figure combines the proposed 39.6% top ordinary income tax rate with the increased 5% NIIT (including a 1.2% hike for high earners).

What about unrealized gains?

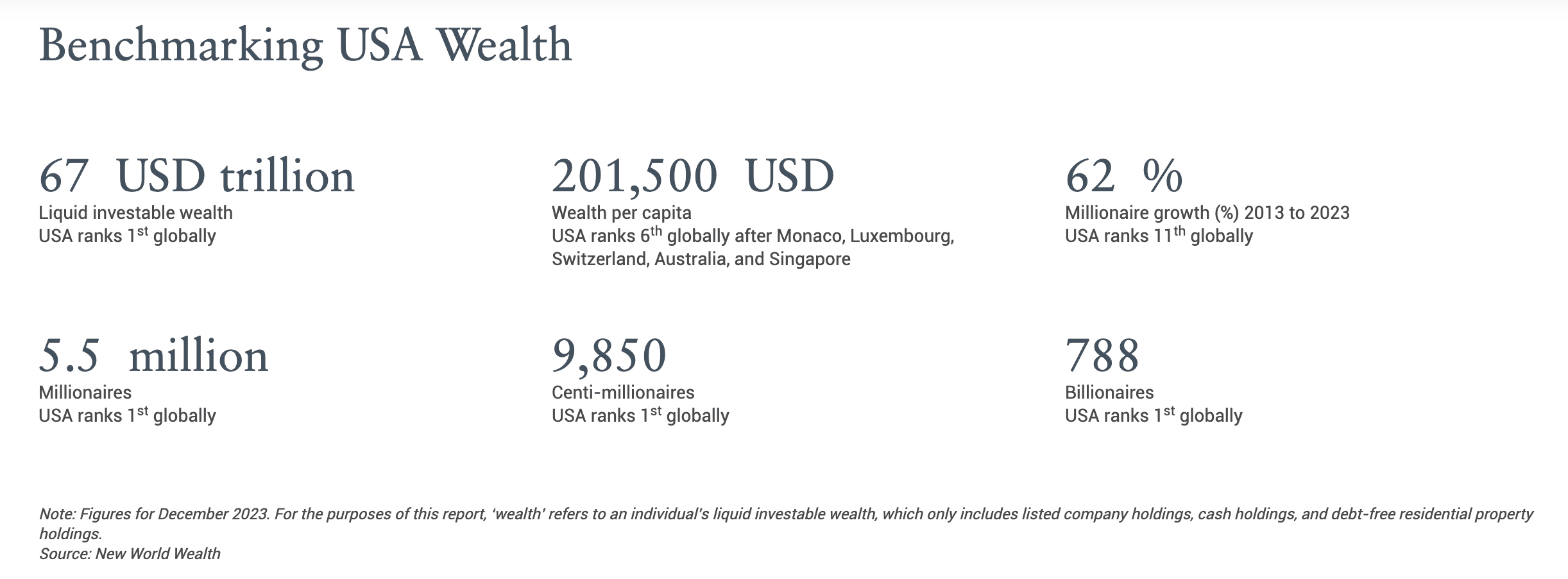

The phrase “unrealized capital gains” is included in Biden’s 2025 proposal as part of a minimum income tax (25%) for the wealthiest Americans, affecting less than 10,000 individuals. These are the so-called “centi-millionaires” with wealth over $100 million.

In essence, the widely discussed and criticized tax proposal would be irrelevant for most crypto traders and investors.

For perspective, the conversation on X was about a tax proposal that would affect just 0.0028% of the U.S. population—and Harris hasn’t endorsed it.

Public reaction and controversy

The recent debate around Vice President Harris and her (rumored) stance on taxing unrealized capital gains ignited a firestorm on social media.

Reports suggest that Harris is aligned with the Biden administration’s 2025 tax proposals, but her team has yet to endorse all the proposed changes officially.

A January 2024 analysis by Americans for Tax Fairness revealed that U.S. billionaires and centi-millionaires held $8.5 trillion in unrealized capital gains in 2022. This amount could be a potential goldmine for federal revenue but has also sparked intense debate.

Certified financial planner and CNBC advisor council member Douglas A. Boneparth criticized the idea of taxing unrealized gains, calling it “dumb.”

Aaron Levie, CEO of Box, shares the same belief, stating that “unrealized gains are simply a field in a database and not useful until converted into something of value.”

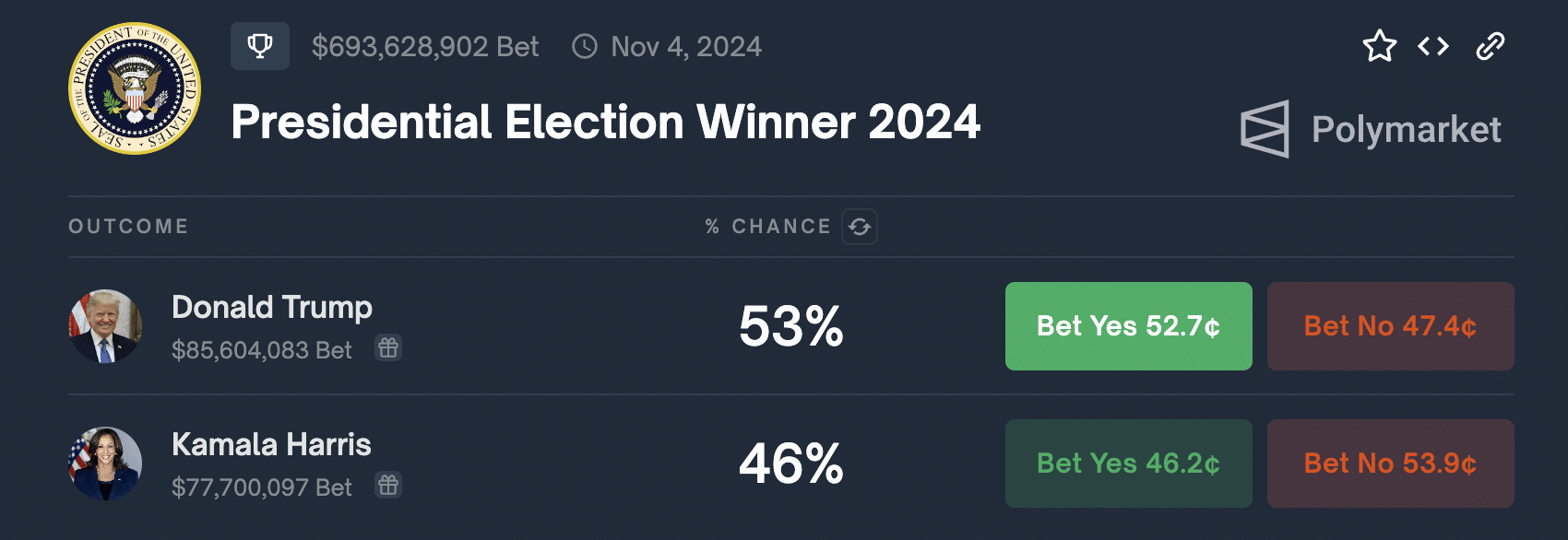

Interestingly, according to Polymarket, while Harris was once leading the race with strong odds of winning the election, her chances have recently dipped to 46%. Meanwhile, Trump, who was slightly behind, has retaken the front seat with odds now at 53%.

Clearly, when it comes to tax policy, the devil is in the details. Social media underscores that even the smallest detail can cause a big stir.