Another lawsuit has been filed against the Tether stablecoin issuer and the Bitfinex crypto exchange. The plaintiffs accuse the companies of manipulating the price of Bitcoin (BTC) and other digital assets.

The plaintiffs alleged that Tether and Bitfinex inflated cryptocurrency prices by purchasing large quantities of coins, creating the illusion of high demand.

According to the complaint, "Tether issued billions of USDT to itself with no US dollar backing," causing significant harm to crypto purchasers.

The initial claim stated that Tether issued $3 billion worth of unbacked USDT tokens, which Bitfinex used to buoy cryptocurrency prices during market downturns.

Proceedings against Tether and Bitfinex

The case against Tether and Bitfinex began in 2019 and has yet to conclude. Defendants argue the accusations are baseless.

The companies’ representatives state that plaintiffs have not provided concrete evidence of price manipulation.

Five traders claim they suffered heavy losses from buying cryptocurrency at inflated prices.

Defendants’ lawyers argue that the charges are based on speculation, not direct evidence, and that plaintiffs failed to prove price manipulation.

The charges include violations of the U.S. Commodity Exchange Act, RICO Act, money laundering, pump and dump schemes, and investor deception.

Paolo Ardoino gets ready to annihilate

Bitfinex announced that a new "baseless" lawsuit had been filed against it and Tether. The company stated it would contest the lawsuit in court.

Paolo Ardoino, the exchange’s technical director, tweeted about the decision to "annihilate this."

Attracting Bittrex and Poloniex

In June 2020, plaintiffs accused exchanges Bittrex and Poloniex of aiding Tether and Bitfinex during the 2017 Bitcoin rally.

Court documents allege Bittrex and Poloniex helped create the illusion of fresh liquidity, influencing market prices.

Penalty for Tether and Bitfinex

In February 2021, Bitfinex and Tether settled with the New York City Attorney’s Office, paying $18.5 million in fines and agreeing to quarterly activity reports.

Stuart Hoegner, Bitfinex and Tether general counsel, stated the settlement was a step to move past the issue and grow their business.

The settlement aimed to resolve concerns about the reserves backing USDT, providing transparency for investors.

Tether continues to lead despite lawsuits

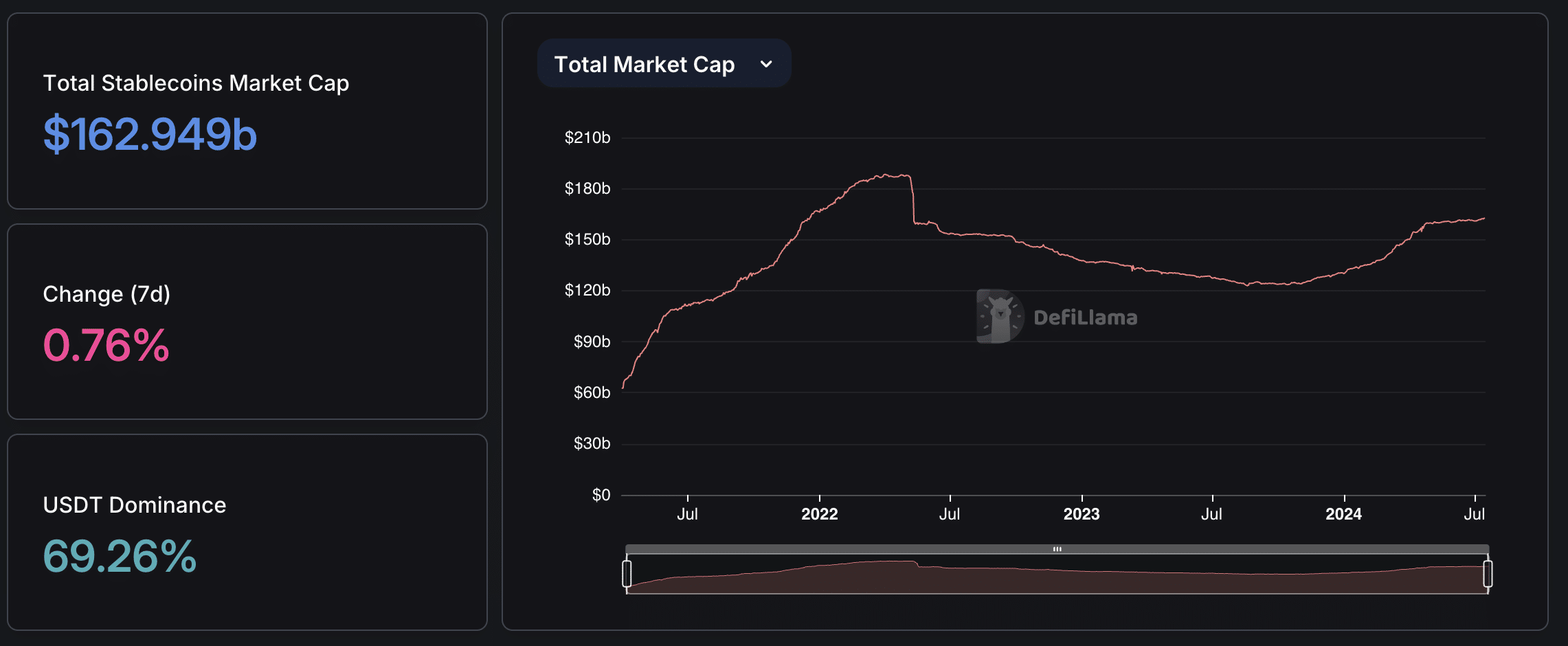

Despite numerous lawsuits, Tether remains the dominant stablecoin. USDT’s market capitalization has reached a record $113 billion, commanding 70% of the stablecoin market.

The increase in supply indicates strong capital accumulation in the digital currency market, reinforcing Tether’s leading position.