Solana price has stabilized above a key support level as signs of bottoming emerge ahead of the spot Ethereum ETF approval.

The SOL token was trading at $140 on Monday, slightly above the crucial support level of $120.50. Its market cap has risen to over $65 billion while its staking yield has risen to 7%.

Spot Ethereum ETF approval

A potential catalyst for Solana is the upcoming spot Ethereum ETF approval, which could happen as soon as this week. If approved, billions of dollars could flow into these funds, as witnessed with Bitcoin earlier this year.

Analysts believe that the Securities and Exchange Commission (SEC) will start to focus on spot Solana ETFs after this.

VanEck has already filed its application for a Solana ETF, and more companies like BlackRock, Franklin Templeton, and Ark Invest will likely apply for a Solana fund.

Such a fund makes sense because Solana is the fifth-largest cryptocurrency, following Bitcoin, Ethereum, Tether, and BNB. It also has a substantial daily trading volume, which stands at over $4 billion.

Solana is also the third-biggest blockchain in the Decentralized Finance (DeFi) industry after Ethereum and Tron. It has over $5.4 billion in assets and over 836k in active addresses in its ecosystem.

Solana has become a favorite blockchain among developers due to its fast transaction speeds and low transaction costs. As a result, it has become a popular network, especially among meme coin developers.

Solana price bottoming signs

Solana price chart

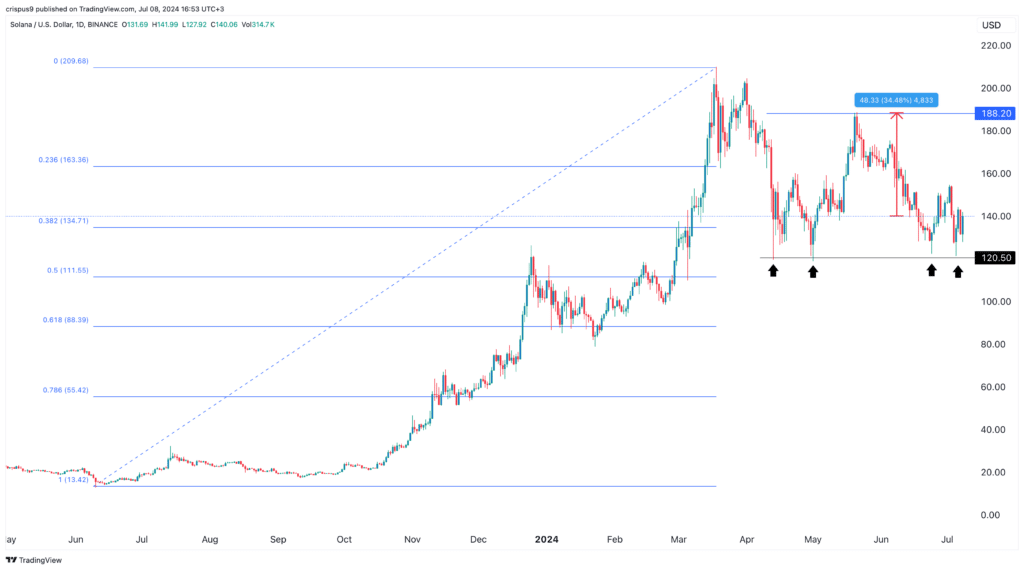

The chart above shows that SOL price has found a strong support at $120.50, where it has failed to move below four times since April 13th. This price is also a few points above the 38.2% Fibonacci Retracement point, indicating that bears are hesitant to short the coin below this level.

It is also a sign that the coin has formed a double-top chart pattern whose neckline is at $188.20, which is about 35% above the current level.

On the flip side, a drop below that support level will be a sign that bears have prevailed, which will lead to more downside.