Senator Cynthia Lummis released a report opposing the proposed 30% energy excise tax on miners.

The politician published a report entitled “Powering Down Progress: Why A Bitcoin Mining Tax Hurts America,” which examines the Administration of U.S. President Joe Biden’s proposal to introduce a 30 percent excise tax on the energy consumed by Bitcoin (BTC) miners.

What the report says?

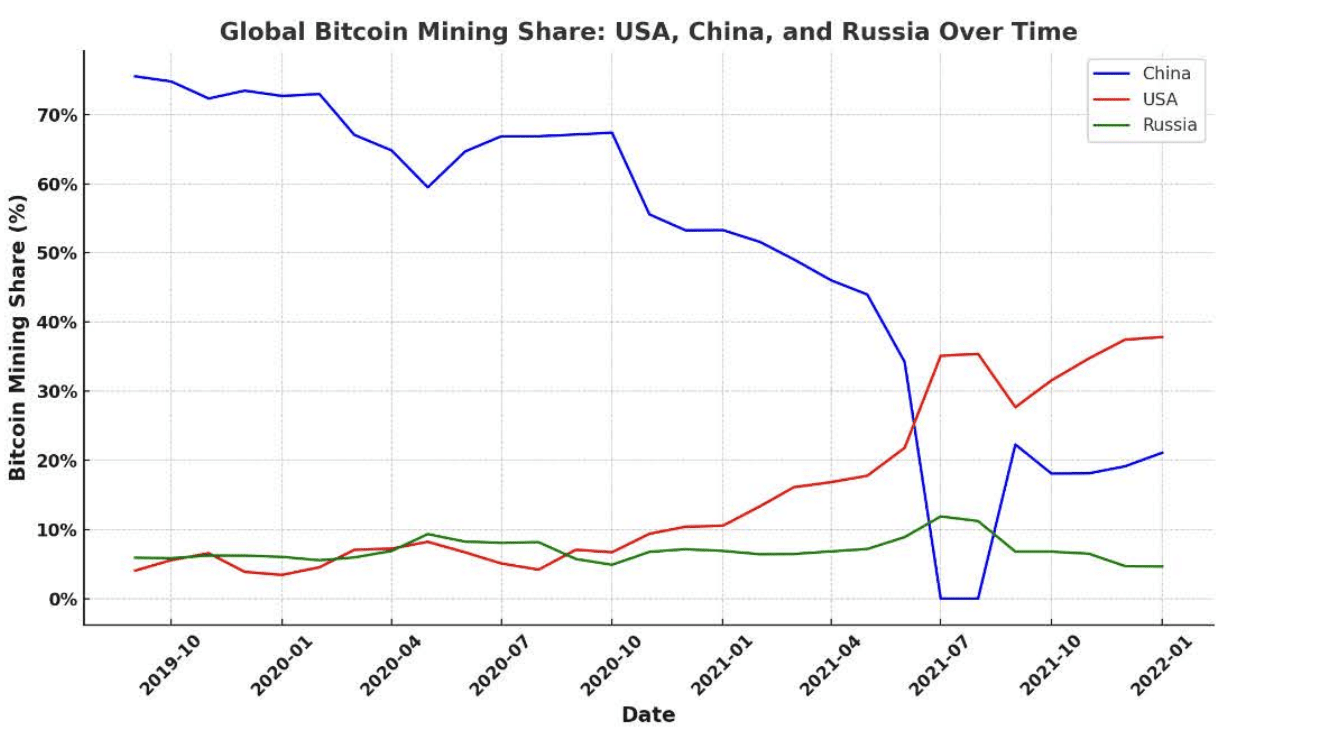

According to Lummis, this move by the Biden administration could destroy the booming American Bitcoin mining industry, which began to develop after China banned mining.

Source: Bitcoin mining paper

Senator Lummis believes the tax could push the industry out of the country into the hands of other nations. She noted the Treasury’s reasons for the tax are based on outdated views about energy use and technology.

Lummis cited the Bitcoin Energy Sustainability and Emissions Tracker as evidence that Bitcoin mining is cleaner than commonly thought, noting up to 52.6% of BTC mining could be emissions-free.

“In terms of the amount of energy used, Bitcoin mining uses approximately as much energy as standard household appliances. For example, a recent KPMG report found that the total energy used by bitcoin miners is roughly the same as the total energy used by tumble dryers.” – Bitcoin mining paper

Lummis also highlighted the role of Bitcoin mining facilities in ensuring energy system security. These operations can balance and redistribute energy across networks as needed.

Furthermore, the senator argued the proposal could harm the objectives it’s intended to achieve. She pointed out that Bitcoin mining strengthens energy networks, countering claims that it threatens local energy systems.

Finally, Lummis explained that imposing a 30% excise tax would discourage miners from seeking sustainable energy forms and new processing methods.

Bitcoin mining tax

In March, the U.S. Presidential Administration proposed a 30% excise tax on electricity used for mining cryptocurrencies like Bitcoin.

Biden administration is proposing a 30% tax on electricity used by #bitcoin miners, even if you are off-grid using your own solar and wind generation. All of the reasons they provide are pretextual, their real reason is that they want to suppress Bitcoin and launch a CBDC. pic.twitter.com/juNHvO2NBx

— Pierre Rochard (@BitcoinPierre) March 12, 2024

The document justified the tax by stating that increased energy consumption for digital asset extraction harms the environment and raises energy prices.

The tax is expected to be phased in: 10% in 2025, 20% in 2026, and 30% eventually. The taxable base will be the electricity consumed for mining, even if produced off-grid.

Lummis criticized the initiative, arguing that the tax would deprive the crypto industry of any foothold in the United States.

The White House 2025 budget is incredibly bullish on crypto assets, some might even say they believe it’s going to the moon.🚀

But a proposed 30% punitive tax on digital asset mining would destroy any foothold the industry has in America.

— Senator Cynthia Lummis (@SenLummis) March 11, 2024

The first attempt to introduce a tax on mining

In May 2023, the Council of Economic Advisers under the Biden administration proposed a 30% tax on electricity used by miners. The plan called for a 10% tax beginning in 2024, increasing to 30% by 2026.

Politicians have criticized mining’s environmental impact due to its significant electricity consumption. The Administration estimated that DAME could generate $3.5 billion in revenue over ten years.

However, the initiative faced backlash from American mining companies, who saw it as a push to marginalize the cryptocurrency community and drive crypto businesses out of the country.

The White House argued that intensive electricity consumption by miners could increase electricity prices and destabilize power grids. They also stated that crypto mining does not provide local economic benefits.

American miners consume electricity as much as an entire state

Although American mining began about a decade ago, the industry has grown significantly since 2019. This growth is mainly due to cryptocurrency mining operations moving to the U.S. after China cracked down on miners in 2021.

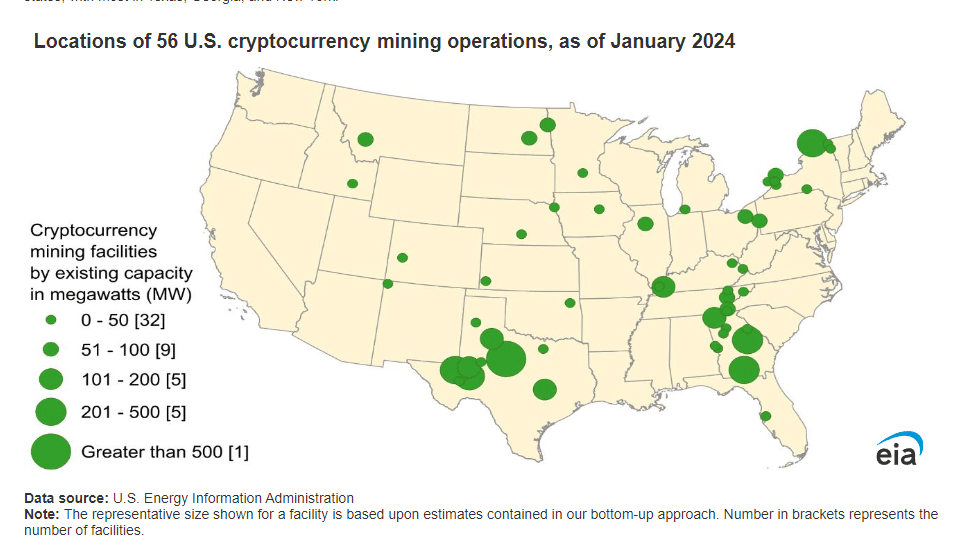

By last year, crypto miners accounted for 0.6% to 2.3% of all U.S. energy consumption—comparable to the entire state of Utah, according to the Energy Information Agency (EIA).

At the end of last year, 137 mining farms were spread across 21 states, with the most activity in Texas, New York, and Georgia. In 2023, Bitcoin mining energy consumption reached between 0.2% and 0.9% of global energy consumption.

How will the law affect mining in the U.S.?

Last year, the U.S. abandoned plans to impose an additional 30% tax on industrial crypto-mining businesses. If this law is abandoned again, the U.S. mining industry will likely flourish.

This could position the U.S. strategically in the digital economy and attract high-tech investments globally. Therefore, the proposed restrictions and tax increases for miners may not be accepted.