Solana’s (SOL) price has bounced back after bottoming at $121.50 earlier this month. It has rebounded by almost 50% and is hovering near its highest swing since May 21.

Solana’s (SOL) price has bounced back after bottoming at $121.50 earlier this month. It has rebounded by almost 50% and is hovering near its highest swing since May 21.

Solana’s ecosystem is booming

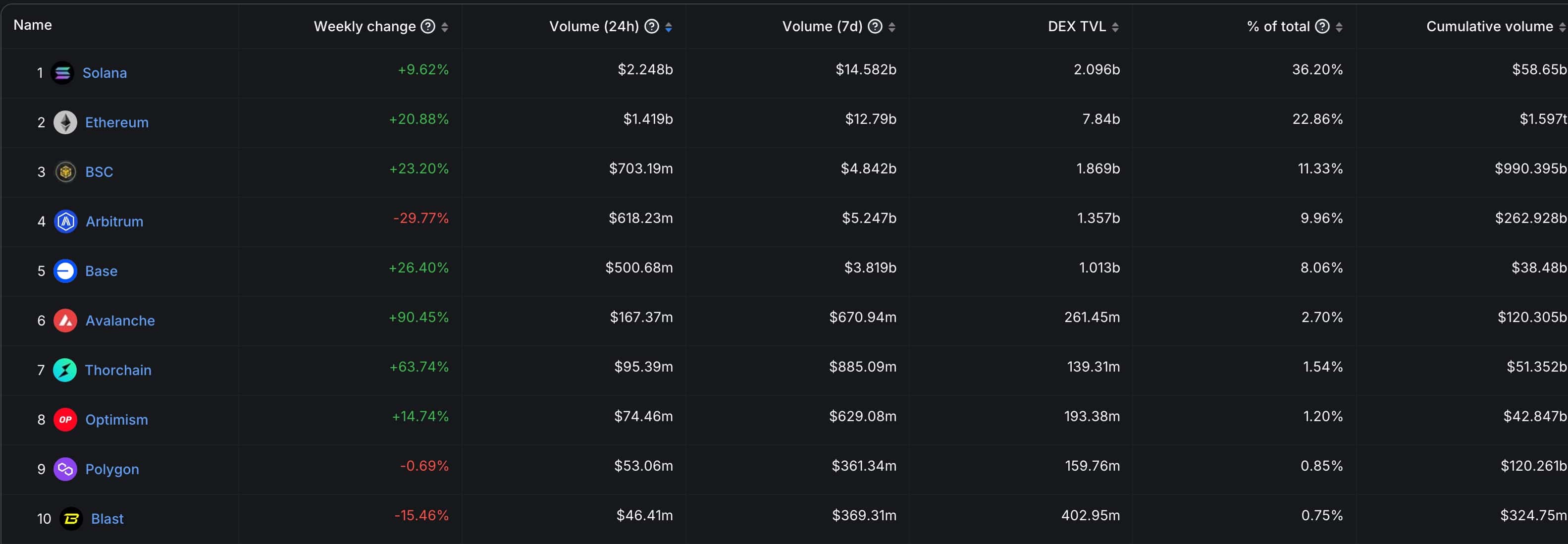

Solana has been one of the most active blockchains this year. DefiLlama data shows that its DEX volume has flipped Ethereum, thanks to the performance of meme coins like Dogwifhat (WIF) and Bonk.

Solana has also become one of the biggest blockchains for Decentralized Public Infrastructure (DePIN). Key projects include Hivemapper, a decentralized alternative to Google, and Helium.

Solana has also become a leading player in the stablecoin industry. Solscan data shows its stablecoin market cap has jumped recently. It has over $2.6 billion worth of USD Coin and $1.88 billion worth of Tether. The number of stablecoin holders in the ecosystem is over 3 million.

Developers love Solana due to its lower transaction fees. This year, despite its busy network, total fees are $283 million, while Ethereum has made over $1.7 billion. Companies like Lido Finance and Uniswap have collected more in fees than Solana.

Most Polymarket users don’t expect Solana price to hit ATH

Despite these metrics, most participants in Polymarket believe that Solana’s price will not jump to a record high this year. Fifty-seven percent of the $219,950 stake in the trade supports this, while 22% and 21% expect it to reach a record high in Q4 and Q3, respectively.

Solana reached its record high of $260 in 2021. As such, it must rise by another 45% to hit that level. A 45% jump in the crypto industry is possible, as some analysts are predicting.

A potential catalyst for such a move could be the possibility of a spot Solana ETF approval by the Securities and Exchange Commission (SEC). If the SEC approves Ethereum, as is widely expected, the focus will turn to Solana, where VanEck has made its first application.