Bitcoin price was trading lower on Thursday as a negative sentiment in the crypto industry continued while the German government dumped more tokens.

The BTC token dropped to a low of $59,918, its lowest point since May 1. It has also moved into a technical bear market as it dropped by 20% from its highest level this week.

Peter Schiff, a well-known player in the financial industry and Bitcoin bear, continued to warn about Bitcoin. In an X post, he warned that the coin would drop sharply if it lost a crucial support level.

Peter Schiff is one of the most high-profile bears in the market. Over the years, he has recommended investing in gold, which he sees as the best alternative to the US dollar.

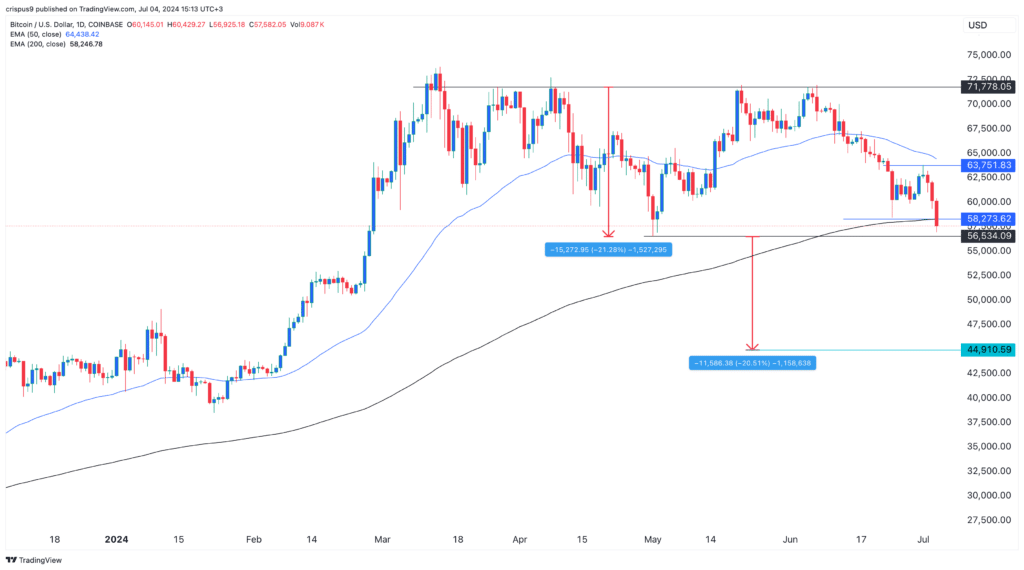

Bitcoin price chart

This view is in line with what was reported on Wednesday when the charts identified $56,534 as an important support level. That price is the neckline of the quadruple top pattern at $71,780 and also the 200-day moving average level. Therefore, if this support is broken, there is a likelihood that it will drop to the psychological level at $50,000 followed by $44,000.

German sales and miners capitulation

Bitcoin’s sell-off accelerated after on-chain data showed that the German government continues to sell its Bitcoin holdings.

It transferred 3,000 coins to Bitstamp, Coinbase, and Kraken. At the current price, the new tranche is valued at over $174 million. It now holds 40,359 coins valued at over $2.3 billion, which it will likely liquidate.

Germany is not the only entity that is selling its Bitcoins. There are signs that Bitcoin miners have started to capitulate by selling their holdings. Julio Moreno, of CryptoQuant noted that these companies would start to capitulate if Bitcoin faces strong resistance.

There are also signs that the US government will start selling Bitcoins worth over $9 billion. These coins are linked to Mt. Gox, an exchange that collapsed in 2014.

All this is happening at a time when data shows that the amount of Bitcoin balances in exchanges has continued rising in the past few days.

Bitcoin balances in exchanges are rising

The other risk is related with US politics, where the consensus view is that Joe Biden will step down and be replaced by a stronger candidate. Some of the suggested candidates are Kamala Harris, Gretchen Whitmer, Gavin Newsom, and Michelle Obama.

These candidates have a chance to beat Donald Trump, who is seen as a more crypto-friendly presidential candidate.

At the same time, Bitcoin’s open interest in the futures market has continued falling, which is a bearish sign.