German MP and major Bitcoin advocate Joana Cotar has called on the government to halt its rapid sale of Bitcoin.

Instead, she advocates adopting Bitcoin as a “strategic reserve currency” to protect against potential risks in the traditional financial system.

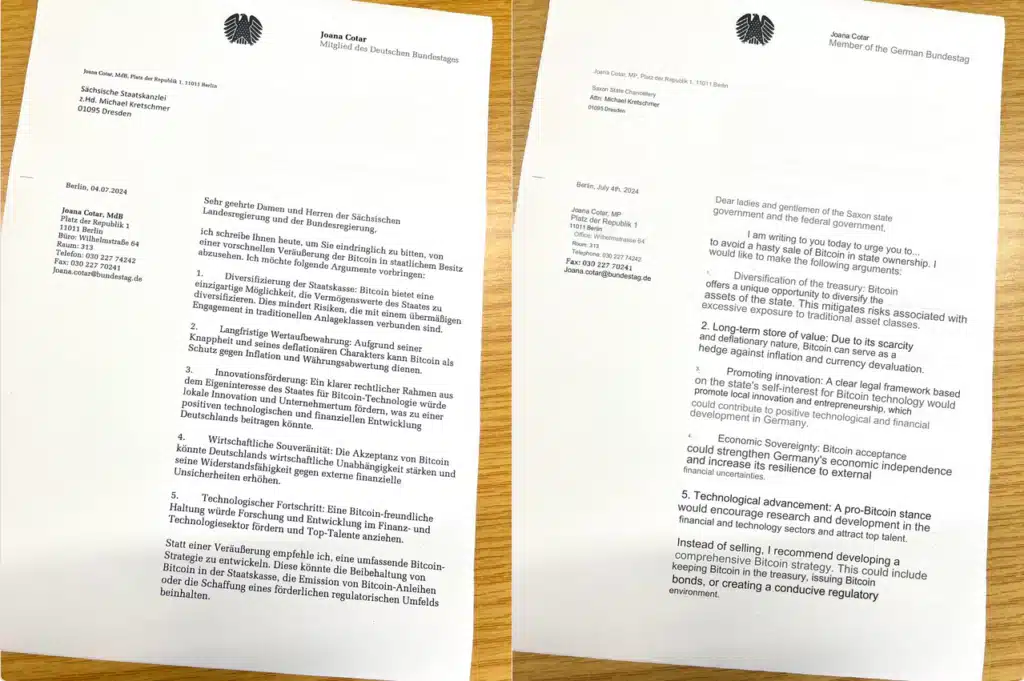

Cotar, in a July 4 X post, suggested that Bitcoin (BTC) could help Germany diversify its treasury assets. She said it would serve as a hedge against inflation and currency devaluation, while also promoting innovation.

Cotar warned that continued sell-offs of Bitcoin would not be sensible and would be counterproductive for the nation. She invited four German lawmakers to the “Bitcoin Strategies for Nation States” event on October 17 to discuss the benefits of Bitcoin.

According to data from the cryptocurrency intelligence platform Arkham, the German government has already sold 8,083 BTC worth around $462.1 million since July 19.

As a result, Germany now holds only 41,774 Bitcoin, worth $2.27 billion, across all its wallets.

Cotar emphasized halting the mass selling of Bitcoin immediately, arguing this could bolster Germany’s economic independence and enhance resilience to financial uncertainties.

“Instead of divesting, I recommend developing a comprehensive Bitcoin strategy, including keeping Bitcoin in the state treasury, issuing Bitcoin bonds or creating a conducive regulatory environment,” Cotar said in the translated statement.

A key component of that strategy would be establishing a legal framework to foster Bitcoin-based innovation and attract global talent.

Meanwhile, the German government has yet to confirm whether it plans to sell the remaining Bitcoin.

Tron founder Justin Sun has proposed to buy the country’s $2.3 billion worth of Bitcoin to minimize market damage.

Germany’s ongoing Bitcoin sell-off and Mt. Gox’s $9 billion compensation plan to creditors have been blamed for Bitcoin’s latest price drop.

Bitcoin’s price continues to fall, dropping below $55,000 and returning to levels last seen in February.

The sell-off has accelerated following claims that the collapsed cryptocurrency exchange Mt. Gox transferred around 47,000 BTC (worth about $2.6 billion) to a new wallet before its $9 billion payout.