The Ethereum (ETH) price hike after a week of downward momentum has triggered increased whale activity.

ETH is up by 5% in the past 24 hours and is trading at $3,065 at the time of writing. The asset’s market cap is currently standing at $368 billion.

The price surge comes as Ethereum recorded a 10.7% plunge over the past seven days.

ETH’s daily trading volume saw a 46% rally, reaching $21 billion. At this point, Ethereum is still down by 37% from its all-time high of $4,891 in November 2021.

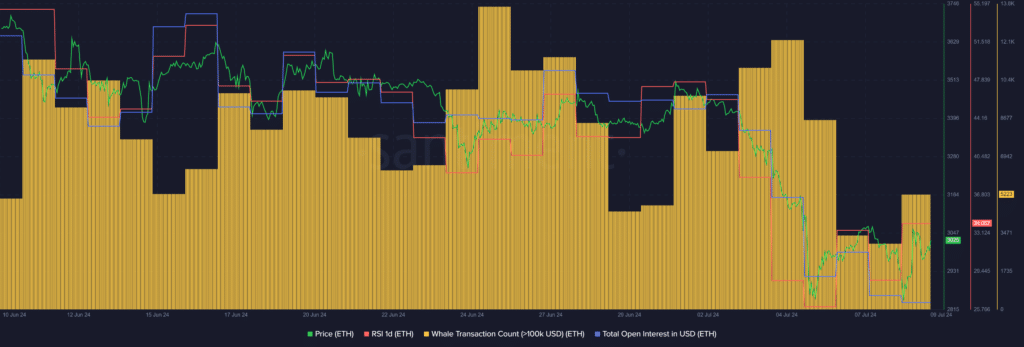

According to data provided by Santiment, the number of whale transactions consisting of at least $100,000 worth of ETH increased by 74.5% over the past 24 hours—rising from 2,995 to 5,223 unique transactions.

While the whale activity around ETH surges, the asset’s total open interest has been constantly declining over the past week. Per Santiment, the ETH open interest plunged from $7.76 billion on July 2 to $6.01 billion at the reporting time. The open interest plunged significantly due to a high amount of liquidations in the past seven days.

Despite the surge in Ethereum’s whale activity and trading volume, its declining open interest could hint at lower price volatility due to decreased liquidations at this price point.

Data from the market intelligence platform shows that the ETH Relative Strength Index (RSI) is currently sitting at 34. The indicator suggests that Ethereum is still oversold in the current market conditions.

One of the main drivers behind the recent market-wide bullish momentum is the $295 million inflows in the spot Bitcoin (BTC) ETFs—helping the BTC price hold above the $57,000 mark.