Ethereum price is up four consecutive days, reaching its highest point since July 3rd. ETH has rallied 20% from its lowest point this month, entering a technical bull market.

ETH was driven by three key catalysts. First, optimism is growing that Donald Trump, viewed as a crypto-friendly candidate, will win the U.S. election in November if Joe Biden exits the race.

These odds improved after the first debate two weeks ago, further buoyed by Trump surviving an assassination attempt. Major endorsements from figures like Elon Musk followed.

Trump’s crypto popularity stems from his support for the industry. He has sold NFTs, opposed Central Bank Digital Currencies (CBDCs), and promised to protect non-custodial wallets.

The second catalyst is the growing likelihood of the SEC approving several spot ETFs. Companies like VanEck, BlackRock, and Invesco have submitted final filings, with approval expected soon.

Ethereum’s ETF approval is significant as it is the second-biggest cryptocurrency. However, approval comes with fees and loss of staking rewards for investors.

Third, ETH supply on exchanges dropped to a record low of 16.76 million from over 32.5 million in July 2016. This indicates rising scarcity as ETF approval nears.

ETH balances in exchanges

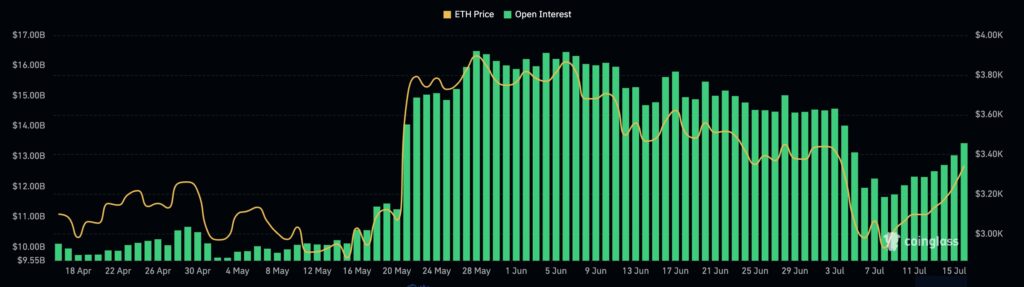

ETH price also surged as futures open interest increased. CoinGlass data showed open interest rose to $13.4 billion, up from $11.66 billion. Most interest came from Binance, Bybit, and Bitget.

ETH open interest

Ethereum price found strong support

ETH’s rebound happened after it found strong support around $2,850, a crucial level this year. It was also just above the 50% Fibonacci Retracement point.

With the token also flipping the 200-day Exponential Moving Average, traders expect the rally to continue. The accumulation and distribution indicator rising signals ongoing dip buying. The next key reference level is $3,500.