Today, Ethereum ETFs made their long-awaited debut on major stock exchanges. Conservative projections suggest these ETFs will attract modest inflows compared to Bitcoin ETFs.

Ethereum ETFs are not expected to match Bitcoin ETF inflows due to differences in market perception and established positions. Bitcoin is seen as "digital gold," while Ethereum has distinct uses.

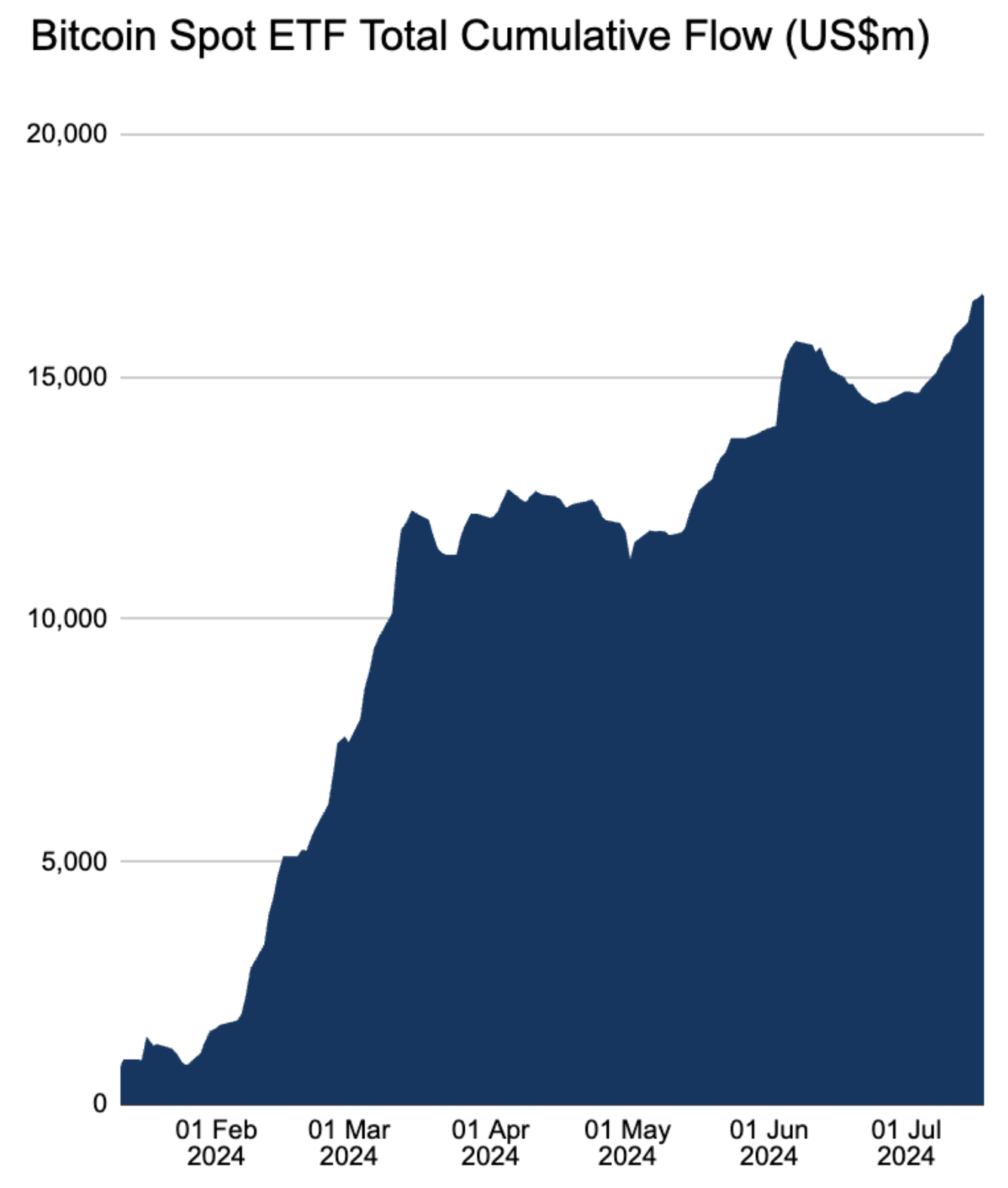

Understanding Bitcoin ETF inflows and their implications for Ethereum

Bitcoin ETFs have seen substantial inflows, with $16.67 billion net inflow over six months as of July 18. Ethereum, while the second-largest cryptocurrency, isn’t typically seen as a store of value like Bitcoin.

Eric Balchunas, a senior ETF analyst at Bloomberg, estimates Ethereum ETF inflows will be just 10-15% of Bitcoin’s.

I think me comparing Ether ETFs following Bitcoin ETFs to a concert where Sister Hazel comes on after Nirvana is prob why a few ppl coming at me on this and that’s ok. Maybe that was harsh but I still see the ether etfs getting 10-15% of the assets of the btc ETFs (altho James is…

— Eric Balchunas (@EricBalchunas) May 21, 2024

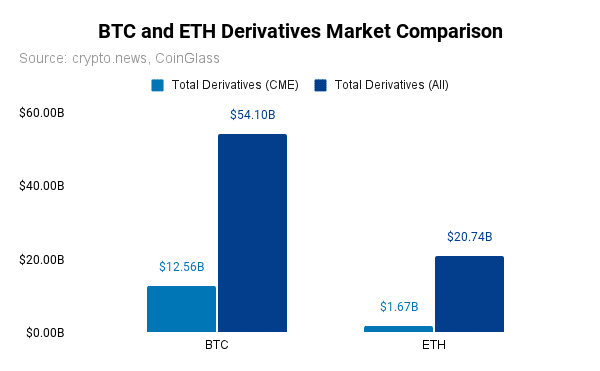

Ethereum futures and options on the CME have an open interest of $1.67 billion, compared to Bitcoin’s $12.56 billion. In the broader derivatives market, Ethereum’s share is about 38.34% of Bitcoin’s.

**Academic insights into ETF effects on market prices**

Studies confirm ETFs’ significant influence on asset prices. Research by Ben-David et al. (2018) shows ETFs can increase volatility and price deviations. Rebalancing and trading strategies of ETFs amplify price movements.

Further evidence from Luca J. Liebi highlights ETFs improving market liquidity and price efficiency under normal conditions. High-leverage ETFs can magnify price changes due to rebalancing activities.

**Potential inflow scenarios for Ethereum ETFs**

Four potential scenarios for Ethereum ETF inflows are:

| Percentage of Bitcoin ETF Inflows | Ethereum ETF Inflows |

|---|---|

| 10% | $1.67B |

| 15% | $2.50B |

| 20% | $3.33B |

| 25% | $4.17B |

These estimates extrapolate from Bitcoin’s $16.67 billion figure.

**Ethereum price impact analysis**

Price impact estimations consider four multipliers: 0.5x, 1x, 1.5x, and 2x.

| 10% | 15% | 20% | 25% | |

| 0.5x | $3,570 | $3,655 | $3,740 | $3,825 |

| 1x | $3,740 | $3,910 | $4,080 | $4,250 |

| 1.5x | $3,910 | $4,165 | $4,420 | $4,675 |

| 2x | $4,080 | $4,420 | $4,760 | $5,100 |

Assuming Ethereum currently trades at $3,400, potential price ranges by the end of 2024 would be $3,740 to $4,675, solely due to ETF inflows.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.