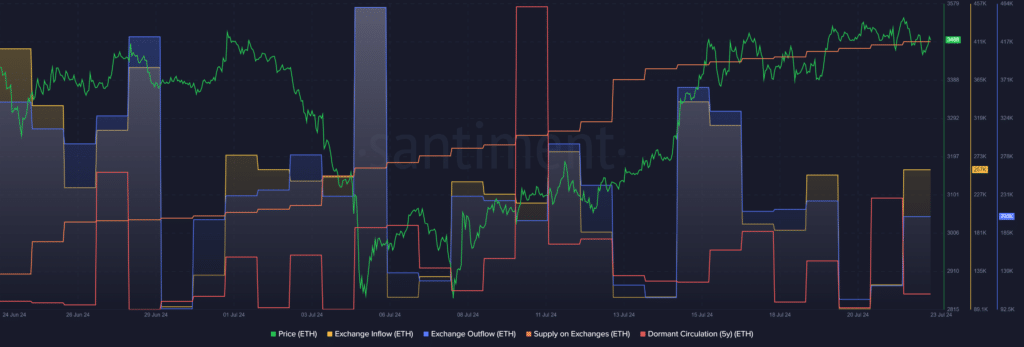

Ethereum has seen increased exchange activity as investors wait for the spot exchange-traded funds to start trading in the United States. The amount of Ethereum (ETH) flowing into exchanges surged by 116% in the past 24 hours, according to data from Santiment.

According to data provided by Santiment, the amount of Ethereum (ETH) flowing into centralized and decentralized exchanges rallied by 116% in the past 24 hours — rising from 118,970 to 257,550 tokens.

This movement is typically expected in bearish market conditions. However, the approval of spot ETH ETFs has triggered this on-chain momentum as traders eye short-term profits.

Data from the market intelligence platform shows a 69% surge in Ethereum exchange outflows over the past day — rising from 121,460 to 205,460 tokens. While outflows hint at an accumulation trend, the rallying inflows suggest potential short-term profit-taking.

Per data from Santiment, the total amount of ETH supply on exchanges increased by 1.2 million coins over the past 30 days — rising from 18.41 million ETH on June 24 to 19.61 million ETH at the reporting time.

This change was due to the market-wide bearish momentum that drove Ethereum’s price from $3,500 to around $2,800 in early July.

Long-term Ethereum holders halted their activity after Monday, July 22. According to Santiment, the five-year dormant ETH circulation dropped from 16,888 to 3,022 coins over the past day.

Ethereum is up by 1.3% in the past 24 hours, trading at $3,530 at the time of writing. The asset’s market cap is $424.3 billion, with a daily trading volume of $21.5 billion.