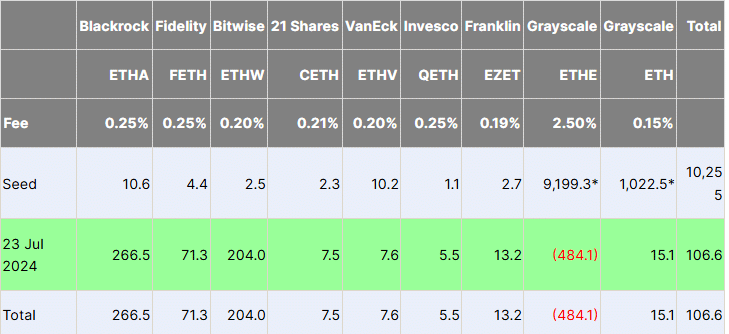

Investors showed strong enthusiasm on the first day of trading for the newly launched Ether exchange-traded funds, transacting over $1 billion worth of shares. According to FarSide data, the trading day for these ETFs concluded with a significant net inflow of $106.7 million.

BlackRock and Bitwise led the influx. BlackRock’s iShares ETF (ETHA) topped the charts with $266.5 million in net inflows, closely followed by Bitwise’s Ethereum ETF (ETHW), which captured $204 million.

Fidelity’s Ethereum Fund (FETH) also saw substantial interest, accumulating $71.3 million in net inflows.

In contrast, Grayscale’s Ethereum Trust (ETHE) experienced substantial outflows, losing $484.9 million, amounting to 5% of its former $9 billion valuation. Originally launched in 2017, ETHE allowed institutional investors to purchase ETH with a six-month lock-up period.

The shift to a spot ETF format has eased the process of selling shares, contributing to the significant outflows observed on launch day.

Grayscale’s Ethereum Mini Trust attracted $15.2 million in inflows, while other funds like Franklin Templeton’s (EZET) and 21Shares’ Core Ethereum ETF (CETH) recorded inflows of $13.2 million and $7.4 million, respectively.

Despite the strong trading volume reaching $1.077 billion, it fell short of the levels seen during the launch of spot Bitcoin ETFs in January, which garnered five times that amount.

The price of Ether (ETH), the world’s second-largest cryptocurrency, experienced a downturn on July 23, affecting the performance of these new ETFs. By the close of the market, Ether was trading flat at $3,486.75.

The introduction of these ETFs marks a significant development in the cryptocurrency industry’s ongoing efforts to have Ether classified as a commodity rather than a security.

While the Securities and Exchange Commission has not definitively classified Ether, the filing documents describe the new products as commodity-based trusts.

Ophelia Snyder, co-founder and president of 21Shares, described the launch of Ethereum ETFs in the US as a pivotal moment for the digital assets industry. Snyder noted that trading proceeded as expected and emphasized the importance of Ethereum’s potential in the long term.

She further noted that this development is positive for both professional and retail investors and will help Ethereum continue to play a significant role in the future of internet and technology investments.