The cryptocurrency market has been dealing with bearish conditions, resulting in over $1 billion in liquidations.

According to data from Coinglass, total crypto liquidations reached $1.06 billion, marking a 454% increase in the past 24 hours. About 85%, worth $900.6 million, were long trading positions — traders expecting price hikes.

Data shows over 278,000 traders were liquidated in the past 24 hours. The largest single liquidation occurred on the Huobi crypto exchange and was worth $27 million.

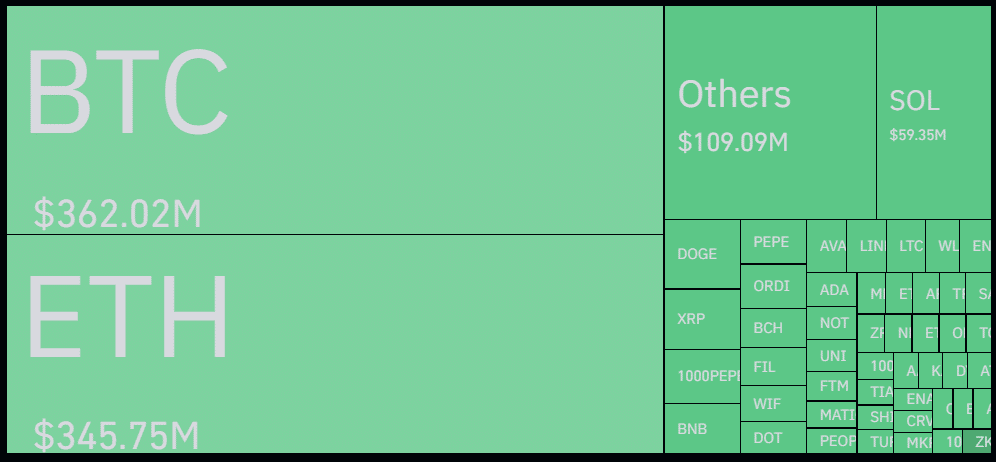

Bitcoin (BTC) accounts for $362 million in liquidations, and Ethereum (ETH) follows closely with $345.7 million in liquidations over the past day.

According to Coinglass, Binance leads with $412 million in liquidations — $342.6 million longs and $69.9 million shorts. The OKX crypto exchange is second with $319.4 million in liquidations — $261 million longs and $57.9 million shorts.

The total crypto open interest decreased by 18.7% and now hovers at $47 billion, Coinglass reports. The increased liquidations coincide with a market-wide bearish trend. According to CoinGecko, the global crypto market capitalization dropped by 13.4% over the past 24 hours, now sitting at $1.94 trillion.

The total crypto daily trading volume, however, increased by 155%, reaching $220 billion.

The leading cryptocurrency, Bitcoin, plunged by 12% in the past 24 hours and is trading at $52,880 at the time of writing. The asset’s price briefly slipped to $49,121, and its market cap dropped below the $1 trillion mark earlier.

Some analysts suggest one potential reason for the market downturn is the escalation of the Iran-Israel conflict, potentially causing wider contagion in global markets, including crypto.