The crypto market has crashed brutally, sending shockwaves through the financial world.

As of August 5, the global crypto market cap stands at $1.81 trillion, a staggering 15.88% decrease in just one day, triggering extreme panic.

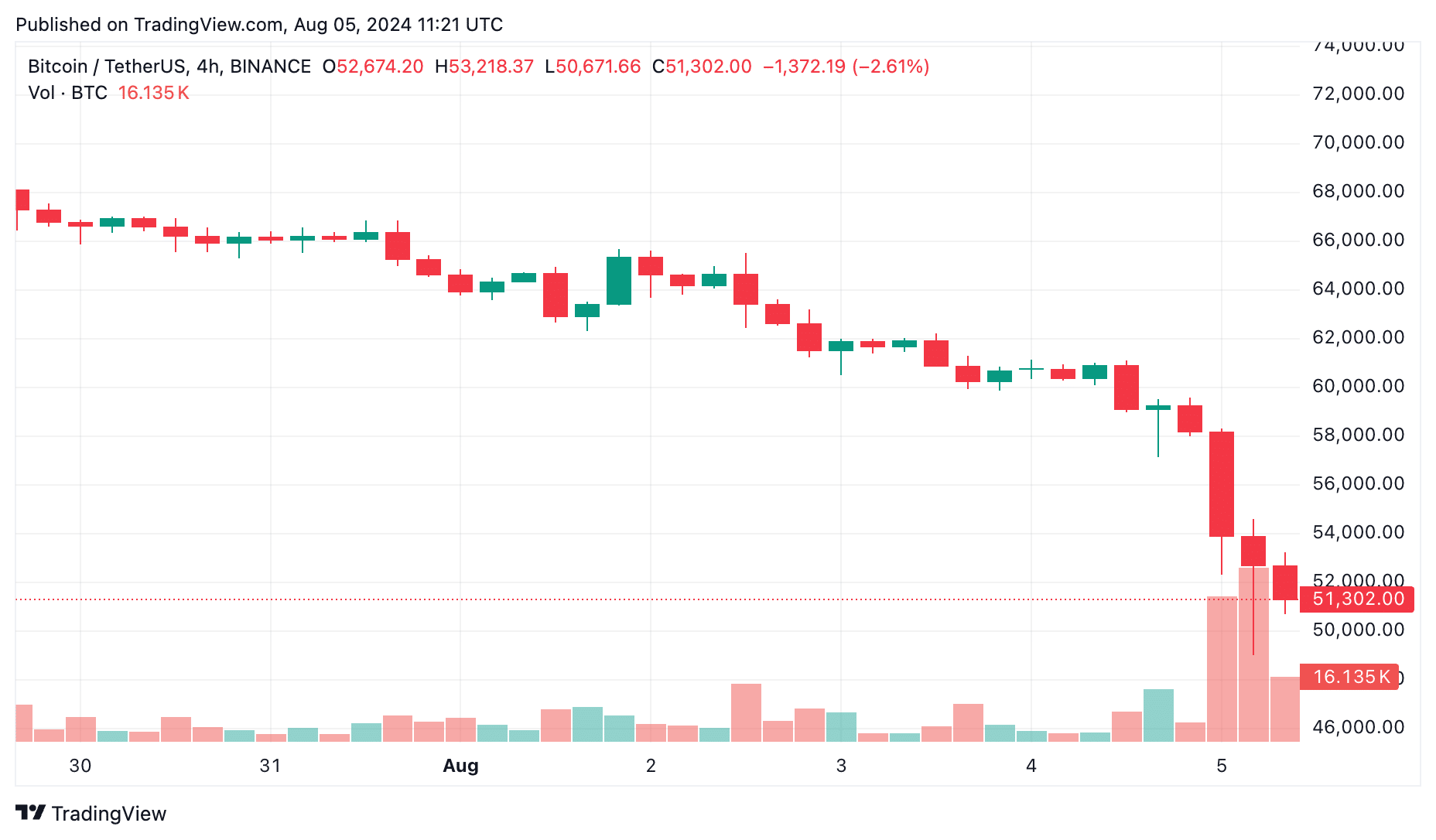

Bitcoin (BTC) has plummeted over 25% in the last seven days, with nearly 15% of that decline occurring in the last 24 hours, trading at $51,300 levels.

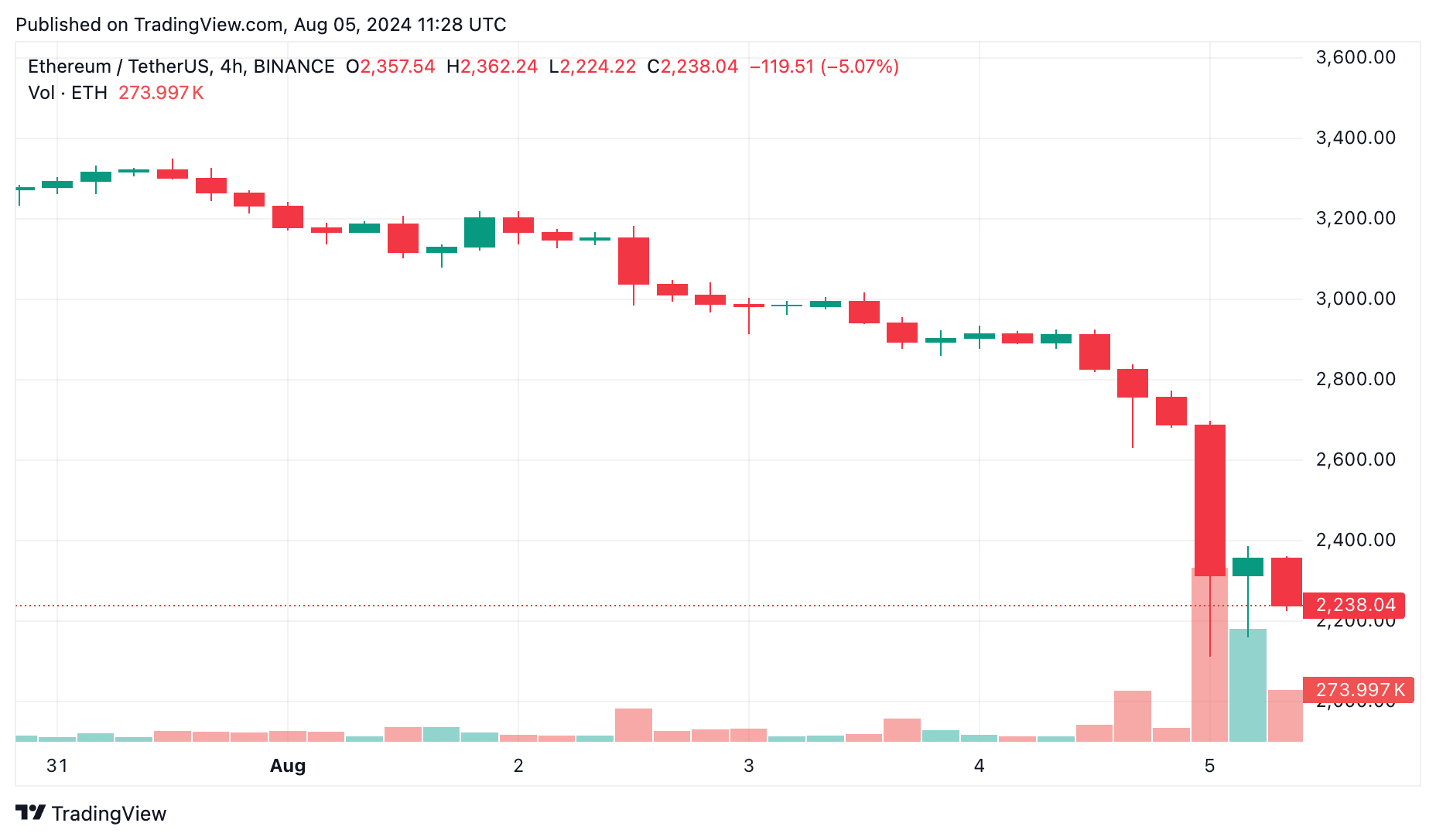

Ethereum (ETH) has fared even worse, falling by 32% in the last week and over 21% in the past day, trading at $2,238 levels.

Other altcoins have been hit hard, too, dropping between 40-50% over the week and 15-25% in the last 24 hours.

The turbulence isn’t limited to the crypto market. Major global stock indices like NASDAQ100 (U.S.), FTSE100 (UK), and NIFTY50 (India) have seen sharp declines of 2-3%.

Japan’s Nikkei225 took the worst hit, plunging nearly 14% in one day, marking its steepest decline since 1987.

So, why is crypto crashing right now? What are the global triggers causing this widespread panic and dragging down financial markets? Let’s delve into the underlying reasons.

What happened to crypto market: decoding the factors

U.S recession fears

The U.S. job market is showing trouble, fueling recession fears. The unemployment rate jumped to a nearly three-year high of 4.3 percent in July.

Economists from Goldman Sachs have increased the probability of a recession in the U.S. next year to 25 percent from 15 percent, Bloomberg reported.

Despite this, they noted there are “several reasons not to fear a slump,” citing the economy’s overall health and the Federal Reserve’s room to cut rates.

However, there are concerns that the Federal Reserve may have “waited too long” to cut interest rates. If the August jobs report is weak, a 50 basis points cut might be necessary.

Rising unemployment and potential recession fears are prompting investors to become more risk-averse, leading to massive sell-offs in the crypto space.

When recession fears rise, people sell risky investments and hold safer assets like cash, gold, or government bonds.

Nikkei 225 crash

Japan’s financial system is undergoing critical changes affecting global markets. On July 31, Japan’s central bank raised its benchmark rate to “around 0.25%.”

This move disrupts the carry trade, causing global financial adjustments. The impact was immediate, with the Nikkei 225 stock index plunging 12.4% on August 5.

The hike aimed to counter weakness in the yen, pushing inflation above the BoJ’s 2% target. This added complexity to the global financial picture.

Early on August 5, the dollar was trading at 142.59 yen, down from 146.45. Stocks began tumbling globally on August 2 due to weaker-than-expected U.S. job data, sparking recession fears.

The stress in U.S. and Japanese markets is causing investors to reassess their positions, leading to a massive sell-off in cryptocurrencies.

Geopolitical woes

Geopolitical tensions are impacting the crypto market. On August 3, tensions in the Middle East escalated following the assassination of Hamas leader Ismail Haniyeh.

This incident follows the killing of Hezbollah’s military chief, causing fears of a regional war. The U.S. announced it would move warships and jets to the region.

Western governments urged their citizens to leave Lebanon, and airlines canceled flights. Iran-backed groups are involved in the ongoing conflict, heightening global instability.

Geopolitical instability often leads to heightened volatility in both traditional and crypto markets, prompting massive sell-offs.

What’s next?

As the crypto market continues to tumble, insights from industry figures offer perspectives on the situation.

Alex Krüger, a macroeconomist, suggests that macroeconomic factors, not crypto-specific issues, are driving the current debacle.

Justin Sun, founder of Tron (TRX), remains optimistic despite the downturn. He suggests the industry has grown and the fluctuations aren’t due to negative news.

During these turbulent times, exercise caution and stay informed. Diversify your portfolio to mitigate risks and avoid putting all your eggs in one basket.

Consider setting stop-loss orders to protect your investments from further decline. Don’t make impulsive decisions based on fear or market hype, and never invest more than you can afford to lose.