Cryptocurrency liquidations surged as the global crypto market cap dipped below $2.5 trillion.

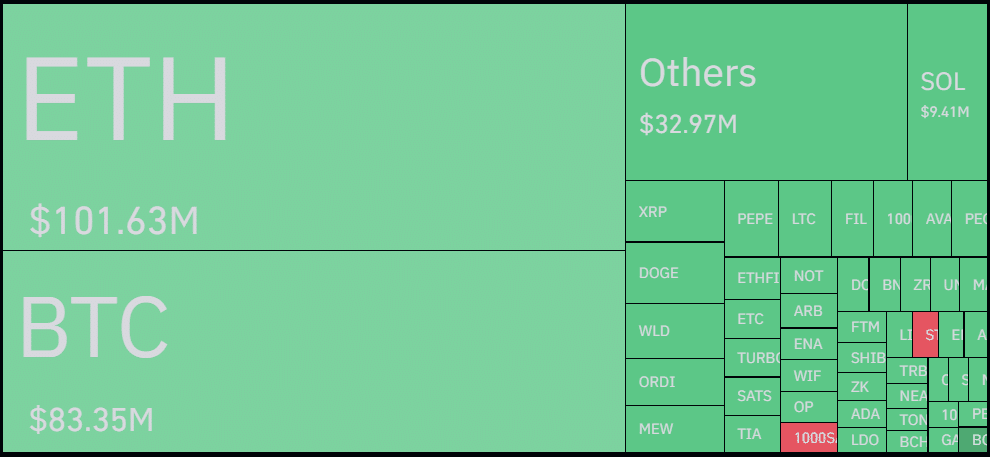

Data from Coinglass revealed a 92.5% increase in crypto liquidations, totaling $292.22 million in 24 hours. A significant 89% of this amount, around $259.7 million, came from long positions.

The remaining $32.5 million was liquidated from short-position holders. Ethereum (ETH) held the largest allocation, with $101.6 million in liquidations — $97.5 million in longs and $4.1 million in shorts. Bitcoin (BTC) followed with $83.3 million in liquidations — $71.5 million in longs and $11.7 million in shorts.

The most substantial liquidation occurred on Binance, the largest crypto exchange by trading volume, with a transaction worth $11.78 million in the BTC/USDT trading pair.

According to CoinGecko, the global cryptocurrency market cap fell by 3.6% over 24 hours, dropping from $2.5 trillion to $2.42 trillion. The market cap briefly peaked at $2.55 trillion on July 24.

Bitcoin hit an intraday high of $67,110 on July 24 before falling near to $64,100. Ethereum suffered an 8.1% price drop, trading at $3,160 at the time of writing. This decline came as U.S.-based spot ETH ETFs recorded a net outflow of $133.3 million on their second trading day.

As a result of the increased liquidations, the total open interest in the cryptocurrency market dropped by 4%, now hovering around $63.6 billion. Lower market-wide volatility is likely with fewer incoming liquidations.