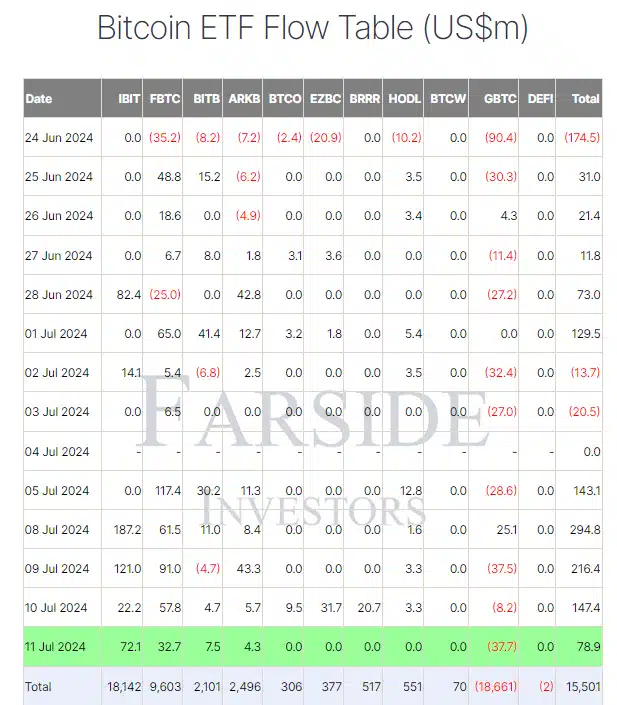

Spot Bitcoin (BTC) ETFs in the U.S. recorded their fifth consecutive day of inflows on July 11, with $72.1 million in net inflows as Bitcoin surpassed the $59,000 mark. According to Farside Investors, these investment products saw $72.1 million in positive net flows on July 11, continuing a trend of inflows that began on July 5 with $143.1 million.

According to Farside Investors, these investment products saw $72.1 million in positive net flows on July 11, continuing a trend of inflows that began on July 5 with $143.1 million.

BlackRock’s IBIT led with $72.1 million in inflows, totaling $18.1 billion overall. Fidelity’s FBTC followed, securing $32.7 million, bringing its cumulative inflows to $9.6 billion.

Bitwise’s BITB and ARK’s ARKB reported increases, with inflows of $7.5 million and $4.3 million, raising their totals to $2.1 billion and $2.5 billion, respectively.

Conversely, Grayscale’s GBTC saw a withdrawal of $37.7 million, resulting in total outflows of $18.7 billion, despite a brief inflow spike on July 8.

Funds like Invesco Galaxy’s BTCO, Franklin Templeton’s EZBC, Valkyrie Bitcoin’s BRRR, VanEck’s HODL, and WisdomTree’s BTCW saw no significant changes. Overall, Bitcoin ETFs had cumulative inflows of $15.5 billion, per Farside Investors.

This influx into Bitcoin ETFs parallels positive economic indicators, as U.S. inflation rates have slowed for four consecutive months.

June saw a 0.1% inflation reduction, the first monthly decrease since May 2020, indicating progress in the Federal Reserve’s inflation management efforts.

Bitcoin prices rebounded from a four-month low, exceeding $59,000 on July 11, up 3.4% over the past week.

The ETF inflows have helped stabilize Bitcoin’s price despite potential supply pressures from Mt. Gox creditors and the German Government’s sale of seized Bitcoin.