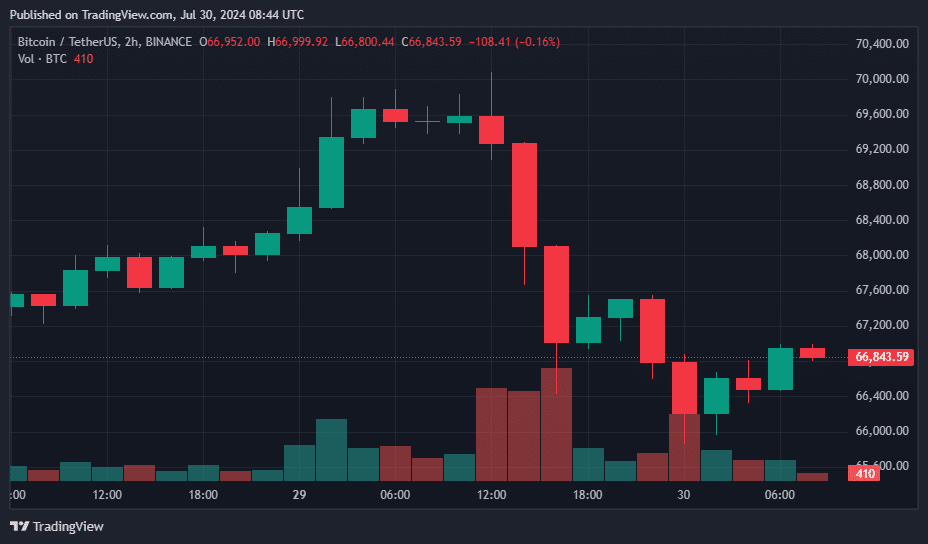

Bitcoin, the leading cryptocurrency by market cap, has pulled back from its six-week high, dipping below the $67,000 mark on Tuesday morning. The decline followed news that the U.S. government moved $2 billion worth of seized Bitcoin, raising investor concerns about potential asset sales.

The U.S. government moved 29.8k BTC worth $2.02 billion out of its total holdings of 183,439 BTC to an unknown address, according to Arkham Intelligence. This prompted market fear.

As news spread, rumors of a potential government sale caused panic, causing Bitcoin’s price to drop to $66,500.

Following Donald Trump’s announcement to start accumulating BTC, Wyoming Senator Cynthia Lummis introduced legislation for a national Bitcoin reserve, proposing the U.S. Treasury acquire an additional one million BTC.

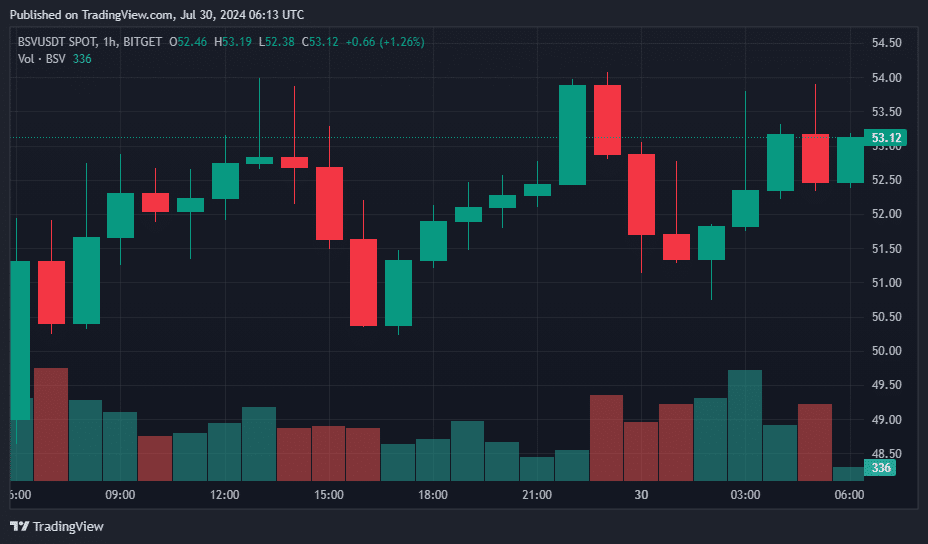

Bitcoin SV Surges Amid Legal Victory

Amid the drop in Bitcoin, Bitcoin SV (BSV) surged 9% in the last 24 hours, becoming the top gainer among the top 100 cryptocurrencies by market cap. The rise follows positive legal outcomes for BSV last week.

The UK’s Competition Appeals Tribunal approved a £10 billion lawsuit initiated by BSV Claims Limited against four exchanges that delisted the token in 2019. The case represents 240,000 UK investors in the Bitcoin Cash hard fork.

BSV was removed from multiple exchanges after Craig Wright claimed he was Satoshi Nakamoto, Bitcoin’s creator. Wright has faced allegations of forgery and lying in court.

BSV’s market cap stands at over $1.2 billion, making it the 77th largest crypto asset. Despite recent gains, it remains down 89% from its all-time high of $490, reached in April 2021.

Other altcoins, including Ethereum (ETH), Dogecoin (DOGE), Ripple (XRP), and Solana (SOL) saw drops between 1-5% in the last 24 hours. The Market Fear & Greed Index is at 67 (Greed) out of 100, per Alternative data.

Currently, the global crypto market cap stands at $2.51 trillion, reflecting a 24-hour drop of 3.2%.