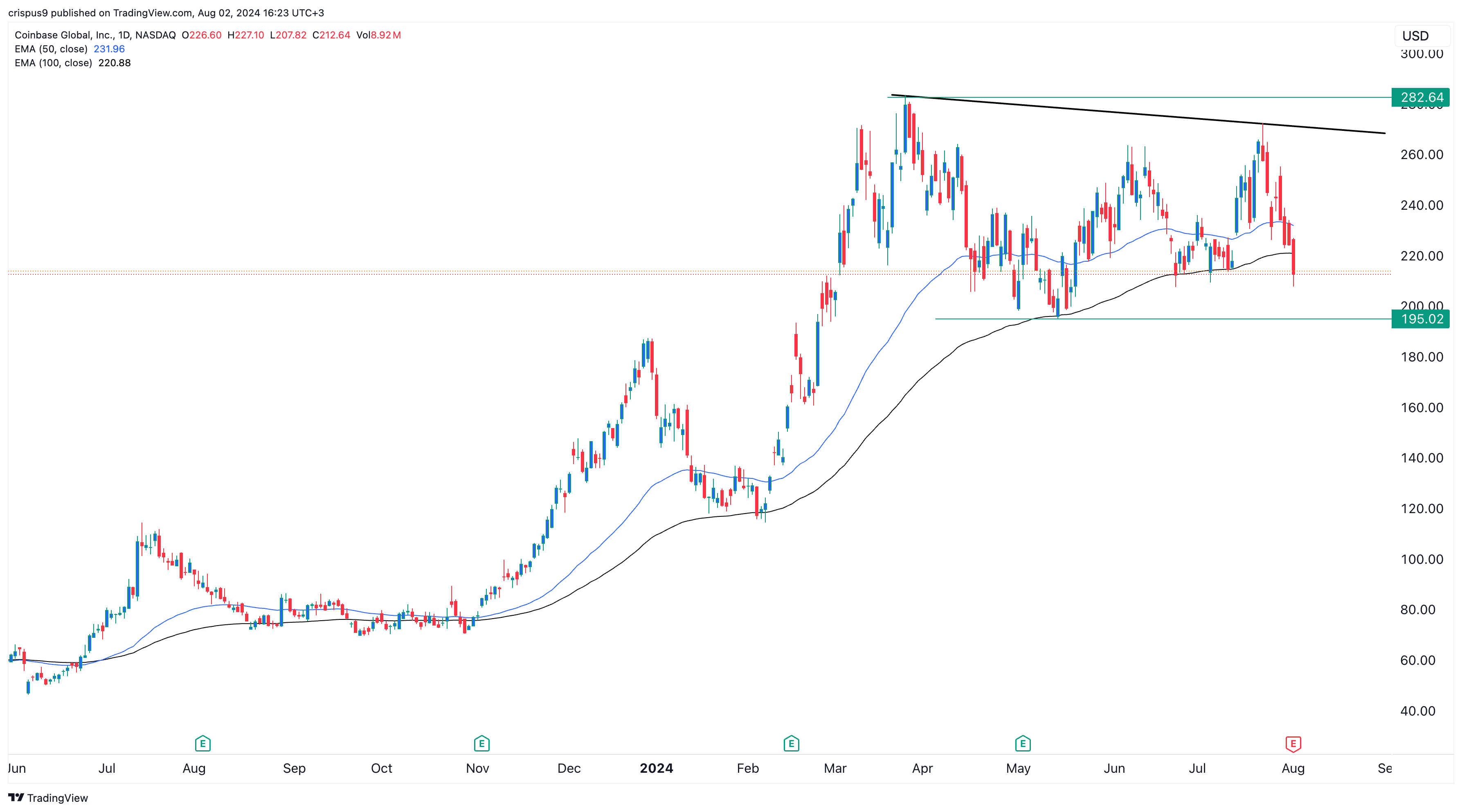

Coinbase stock price has been in a freefall, dropping for eight consecutive days, but one analyst believes that it could rebound to $295, ~40% above its Friday’s open.

Coinbase’s retreat happened as Bitcoin (BTC), Ethereum (ETH), Solana (SOL), and other altcoins suffered a harsh reversal, leading to lower volumes across centralized and decentralized exchanges.

Coinbase earnings

In addition to the trends in the crypto market, the Coinbase stock price reacted to the company’s earnings, which showed the benefit of its diversification.

Coinbase made $1.3 billion in net revenue in the second quarter, a big increase from the $663 million it made in the same period in 2023. The figure was lower than the $1.58 billion it made in Q1.

Coinbase’s net income of $36 million was also higher than the $97 million loss it made in the same period a year earlier. All its numbers were better than its guidance and analyst estimates.

Most importantly, Coinbase’s efforts to diversify its business are working. Its transaction revenue came in at $780 million, while the subscription and services revenue jumped to $599 million.

A big increase in its latter segment was its custodial fee part, whose revenue rose to $34.5 million. This is an exciting business for Coinbase because it has become the biggest custodian for most Bitcoin and Ethereum ETFs. Its figures will see less volatility in the future since investors hold their ETFs for a long period.

The other part of Coinbase’s subscription and services revenue includes its stablecoin, blockchain reward, interest and fee, and other subscriptions.

Analyst is bullish on Coinbase stock

Most Wall Street analysts are bullish on the COIN stock. According to Yahoo Finance, the average analyst price target is $265, 25% higher than its Friday’s open.

Citigroup changed its tune on Coinbase, moving from neutral to buy in July. Other analysts from Needham, Goldman Sachs, and JMP Securities are bullish on the stock.

The latest analyst to comment on the stock was from HC Wainwright, who lowered their price target from $315 to $295, implying a still strong 40% gain from its current price.

The analyst cited two key catalysts to drive shares higher. First, the crypto industry could get the regulatory clarity it has always wanted this year. Brian Armstrong, the company’s CEO, has seen some bipartisan moves about crypto in Congress in the past few months.

Second, HC Wainwright noted that Coinbase has now become a more diversified company, meaning that it is no longer dependent on transaction revenue.

“While it is plausible that we could see crypto asset prices and trading volumes trend sideways in the coming months due to macro-related headwinds/uncertainty, we remain bullish on these critically important drivers for Coinbase as we look out over the next 12-18 months, as we enter the next leg of this bull market cycle for crypto,” the analysts wrote.

HC Wainright faces some technical risks. On the daily chart above, the stock has retreated below the 50-day and 100-day Exponential Moving Averages (EMA), meaning that bears are taking over. It has also formed a slanted double-top pattern whose neckline is at $195.02. A drop below that level will point to more downside.