Altcoins Suffer Heavy Losses as Bitcoin Declines 8%

On July 5, the majority of altcoins, including PEPE, BRETT, JASMY, and FLOKI, fell over 20%, as Bitcoin, the largest crypto asset, dropped 8% in 24-hour trading. The plunge in Bitcoin’s price has sent shockwaves through the cryptocurrency market, significantly impacting altcoins.

At the time of writing, the Ethereum-based meme coin, PEPE, was down 15% in the last 24 hours, trading at $0.0000082. The cryptocurrency’s daily trading volume hovered around $1.29 billion, and its market cap had dropped by 15%, now standing at $3.46 billion.

BRETT, the meme coin which launched four months ago, also dropped 20%, trading at $0.1143, according to CoinMarketCap (CMC). The meme coin, inspired by a character from the “Boy’s Club” comic, had a daily trading volume of $71.3 million. BRETT’s market cap fell to $1.13 billion, ranking it as the 59th largest cryptocurrency per CMC.

JASMY, the native cryptocurrency for the Jasmy ecosystem, also faced a downturn. It was down 15% in the last 24 hours, trading at $0.02083 with a daily trading volume of $177 million. The token’s market cap dropped to $1 billion.

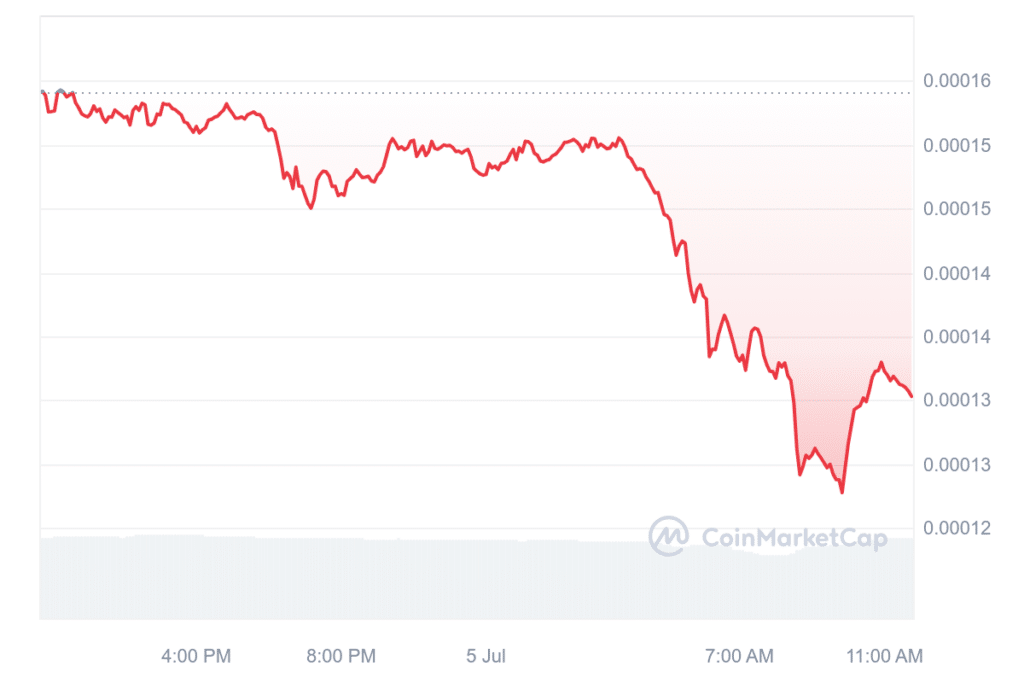

Solana-based meme coin FLOKI dropped 15%, trading at $0.00013. Its daily trading volume stood at $309 million, and its market cap fell to $1.25 billion, placing it at the 55th rank among the top 100 cryptocurrencies.

The sharp decline in these altcoins follows the drop in Bitcoin, which fell by 8% in the past day to $54,426. Its 24-hour lows and highs were recorded as $53,717 and $58,591, respectively.

Bitcoin’s price drop coincided with Mt. Gox transferring 47,229 BTC ($2.7 billion) to an unknown wallet. US spot Bitcoin ETFs experienced outflows of $20.45 million, raising investor concerns. Bitcoin’s dominance increased by 0.58% from the previous day, reflecting a decrease in altcoin market activity.

Ethereum, the largest altcoin, dropped 11% in the last 24 hours, trading at $2860. The altcoin market often sees sharp declines linked to Bitcoin’s performance due to its significant influence and market dominance. When Bitcoin experiences substantial price drops, it tends to create a ripple effect across the cryptocurrency market, leading to widespread declines in altcoin values.

This widespread decline reveals investor sensitivity towards Bitcoin’s performance and signifies the interconnected nature of the cryptocurrency market.