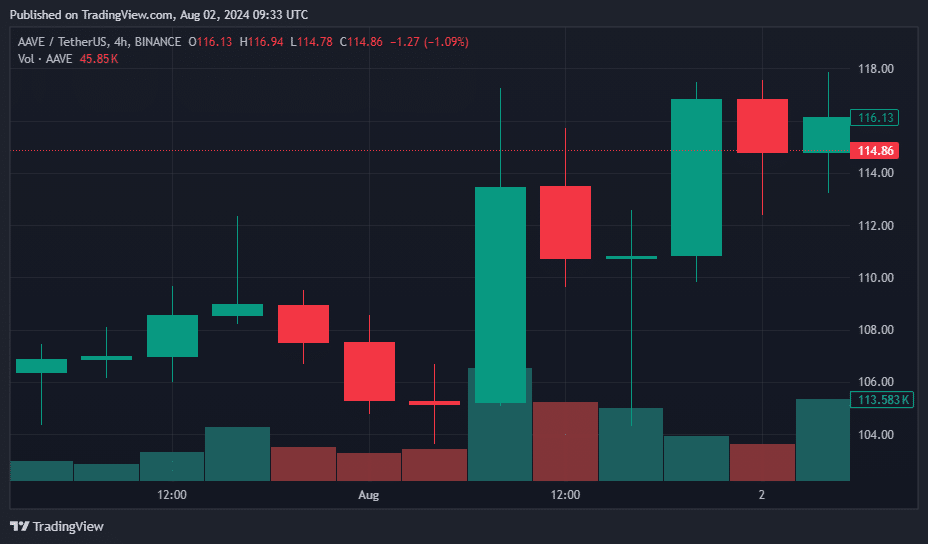

Aave’s price saw a surge of over 10% amid heightened whale activity as the market recovered from a recent drop.

The latest upward movement in Aave’s value followed a report by Lookonchain, which highlighted extensive buying from whales. Over 58,848 AAVE worth around $6.47 million were moved off exchanges.

Detailed transaction data showed that one whale address, identified as “0x9af4,” pulled 11,185 AAVE worth $1.23 million from Binance. Another series of transactions involved the transfer of 21,619 AAVE, valued at approximately $2.38 million, from Binance to Aave. Additionally, address “0xd7c5” had transferred 26,044 AAVE — more than $2.83 million — off Binance.

Further insights from Lookonchain indicated more active trading by a whale who shifted 45,718 AAVE, valued at about $5.21 million, from Aave to Binance within just two hours. The whale had accumulated 74,656 AAVE, costing about $7.12 million, from February to June at an average price of $95.38 each.

The whale’s remaining holdings of 28,938 AAVE are currently valued at $3.28 million, with total profits estimated at $1.37 million.

Aave Labs teases new products as TVL surpasses $12b

Meanwhile, the total value locked in the Aave protocol now stands at approximately $12.63 billion. According to data from DefiLlama, $11.19 billion of this figure was allocated to Aave V3, with the older V2 and V1 versions holding about $1.42 billion and $14.17 million, respectively.

On the development front, Aave Labs announced the launch of Aave V3.1 across all networks with active Aave V3 instances on July 31. This update, approved by Aave DAO governance, includes enhancements aimed at bolstering the protocol’s security, operational efficiency, and user experience.

Looking ahead, Aave Labs has unveiled a comprehensive roadmap for the project, setting ambitious targets, including the development of Aave V4 by 2030.