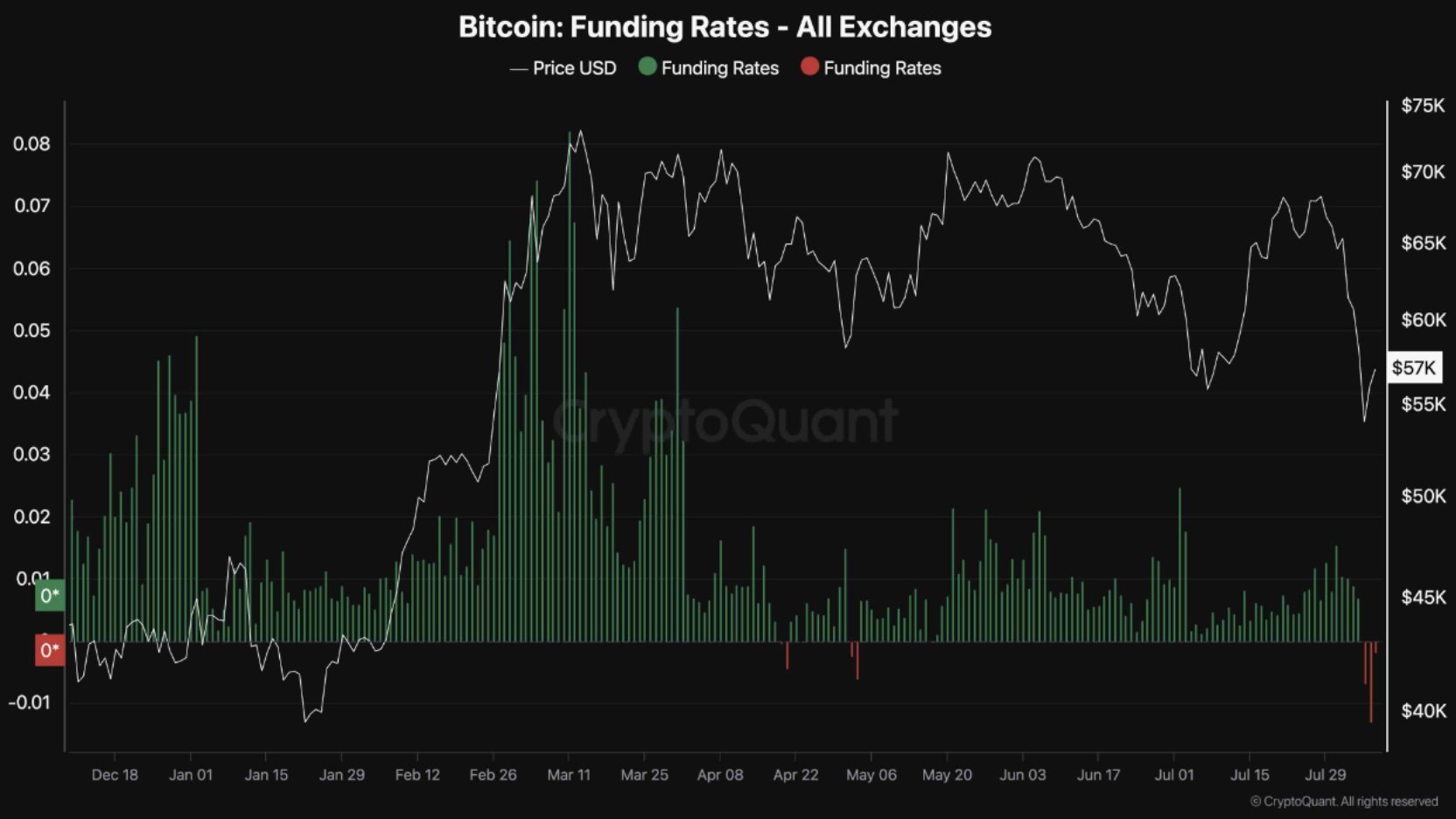

The Aug. 5 market plunge reversed Bitcoin’s funding rate for margin positions, potentially setting the stage for a bullish fourth quarter.

Pseudonymous CryptoQuant analyst ShayanBTC said that Bitcoin’s (BTC) early-August decline may benefit the digital asset before this year ends. The dip to $49,000 triggered a massive deleveraging sweep, flushing nearly $1 billion in BTC longs. The slump wiped out over $1.2 billion in crypto margin positions and reset funding rates to negative.

As a result, short sellers dominated leveraged positions. According to the CryptoQuant researcher, investors could view the development as a net positive “as it suggests the future markets are no longer overheated.”

“Smart Money” remained optimistic about markets as Bitcoin whales padded their holdings by over 404,000 tokens in the last 30 days after last month’s brief ascent to $70,000 and the plunge below $50,000. CryptoQuant data indicated that the accumulation spree coincided with several liquidation events, including Germany’s $3 billion offload and over $6 billion in Mt. Gox creditor repayments.

Investors adding BTC to their coffers is usually bullish for the largest cryptocurrency and signals strong market sentiment adopted by long-term investors, especially when funding rates have declined and created more room for upside momentum.

Bitcoin could range lower before an uptick

While whales bought more BTC, Bitfinex analysts predicted on Aug. 5 that the token could retest support around $48,900 before charging toward all-time highs again.

The assertion agrees with historical data showing that Bitcoin typically struggles in August and September. Gains achieved in July were wiped out by macro-driven market fear, but the year’s fourth quarter may bring relief for BTC.

Before global markets retraced, investors and markets widely expected Federal Reserve rate cuts in September. A dovish outcome at the Federal Open Market Committee meeting next month could direct much-needed liquidity into the crypto market and propel prices.