Ten years after its collapse, the Mt. Gox crypto exchange finally began paying off creditors. What is the reason for this process, which has dragged on for a decade?

Let’s dive deep into the chronology of events associated with the fall of one of the once-largest crypto exchanges.

Table of Contents

The emergence of Mt. Gox

The history of Mt. Gox goes back to the early days of the crypto industry. It all started in 2010 when developer Jed McCaleb founded the Mt. Gox platform for the Magic: The Gathering game, but then transformed it into a Bitcoin exchange.

A year later, he sold the platform to developer Mark Karpeles. After the change in management, Mt. Gox quickly became one of the most popular BTC platforms.

As a result, the first major hacker attack occurred in June 2011. Hackers stole at least 25,000 BTC, or about $400,000, at the time of the attack. Then, the price of Bitcoin on Mt. Gox collapsed from $17 to almost zero.

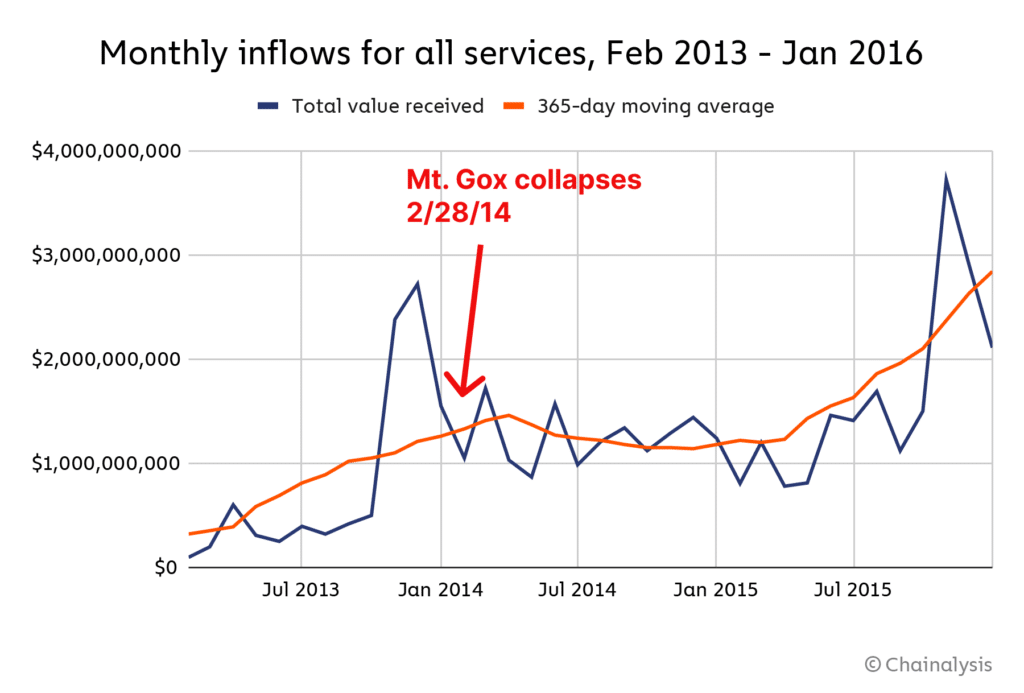

After the attack, Mt. Gox continued to develop, and in 2013, it processed 70% of all Bitcoin transactions worldwide. However, the exchange faced technical problems that led to a significant increase in transaction processing time.

Internal difficulties and hack of Mt. Gox

Despite external success, the exchange experienced great internal difficulties. In particular, Mt. Gox had no control over the quality and security of the code. In addition, the project lacked a financial accounting system and control over balances and reserves. Simply put, no one monitored the flow of money and cryptocurrency.

In February 2014, Mt. Gox suddenly stopped Bitcoin withdrawals. The platform team reported that a bug in the Bitcoin code made it possible to effectively double-spend coins, which the attackers used concerning the exchange’s blockchain address. After that, the platform finally stopped all withdrawals.

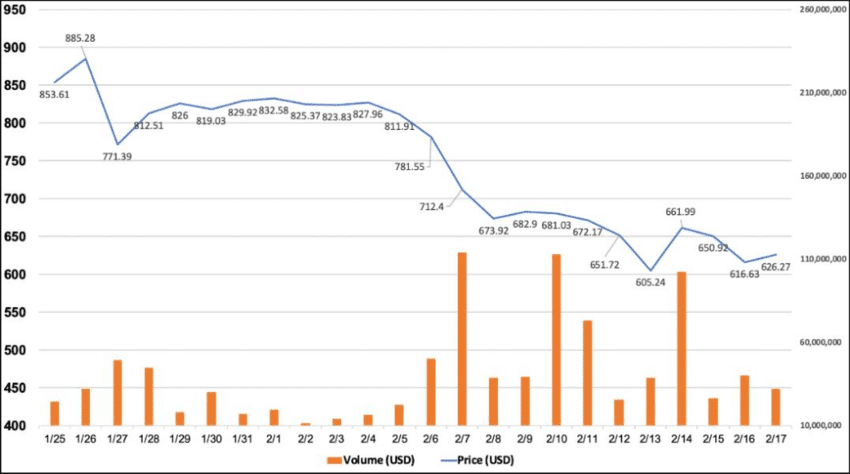

By the end of the month, the price of Bitcoin on Mt. Gox was only 20% of the average market price, which was a clear indication of investors’ confidence that the project would not be able to solve the problems that had arisen. On Feb. 24, 2014, all trading operations were suspended on the platform, and a few hours later, its website went down.

Later, the exchange team discovered the theft of approximately 750,000 BTC from users, which had gone unnoticed for several years. As a result, Mt. Gox became insolvent — on Feb. 28, 2014, it declared bankruptcy and closure.

The hack extent and the mystery of missing Bitcoins

Hackers attacked Mt. Gox and stole 744,408 BTC belonging to customers and 100,000 BTC belonging to the company. This financial disaster led to the exchange being declared insolvent. Later sources indicated that Mt. Gox had already leaked around 80,000 Bitcoins before Karpeles bought it in 2011.

Many theories have formed around the hack. One popular theory suggests that Mt. Gox never actually had the amount of coins it claimed to have and that Karpeles may have manipulated the data to create the illusion of more bitcoins than it had.

As for how the hackers were able to gain access, some speculate that an internal staff member could have gained access. In contrast, others suggest that BTC from the cold storage was gradually transferred to the Mt. Gox system as the hot wallet was depleted. The lack of proper controls allowed the hackers to siphon the assets undetected.

Protracted litigation

From 2014 to 2020, litigation and civil rehabilitation took place. This civil rehabilitation process typically takes three to five years but offers a fairer and more efficient solution for returning assets to affected creditors.

At the same time, the Kraken crypto exchange did not complete the process of collecting and analyzing creditor claims until May 2016. 24,750 users submitted claims for payments.

As a result, the court approved the compensation plan only in early 2021. Then, the exchange’s trustees repeatedly postponed the payment of compensation to creditors, sometimes by a year. They cited technical and administrative delays, including finding the missing BTC and organizing the process of assessing and satisfying creditors’ claims.

Compensations and the impact of the Mt. Gox collapse

The collapse of Mt. Gox was one of the most significant attacks in the crypto industry. The event showed the importance of protecting cryptocurrency platforms and became the starting point for forming legal norms for the entire industry.

On July 5, the exchange’s trustees officially confirmed that they were starting to pay out compensation in Bitcoin and Bitcoin Cash, totaling about $9 billion.

Bitcoin compensation is distributed through the Kraken, Bitstamp, BitGo, and Japanese Bitbank exchanges. According to their agreement terms, they will have several weeks on average to transfer funds to customers. However, when the first batch of coins was moved to Bitbank, its clients began reporting that they had received the funds the same day.

The crypto market participants are concerned about the size of the total compensation and the possible selling pressure on the price of Bitcoin. It is assumed that clients may sell a significant portion of the coins after compensation on the open market.

Against the backdrop of the news, the Bitcoin rate fell below $54,000 in early July—the lowest rate since February 2024. However, by the time of writing, BTC had regained its position, having consolidated at $65,000.

Can the Mt. Gox story repeat?

The crypto industry needs to develop new solutions that combine decentralized technologies’ security with centralized platforms’ efficiency and convenience. However, the Mt. Gox saga cannot be guaranteed to repeat itself.

On one hand, the major crypto exchanges are relatively transparent, offer insured deposits, and are backed by influential venture capitalists. However, many smaller and lesser-known exchanges operate with little transparency.